Investor Insights

SHARE

Are we about to see a profit and dividend bonanza?

We are about to enter reporting season, when most of our listed companies report their results for the prior financial year. With stock market indices at all-time highs, it looks like the market is expecting many of our larger companies to come out with solid earnings and dividend announcements. Perhaps more interesting will be their forecasts for the year ahead.

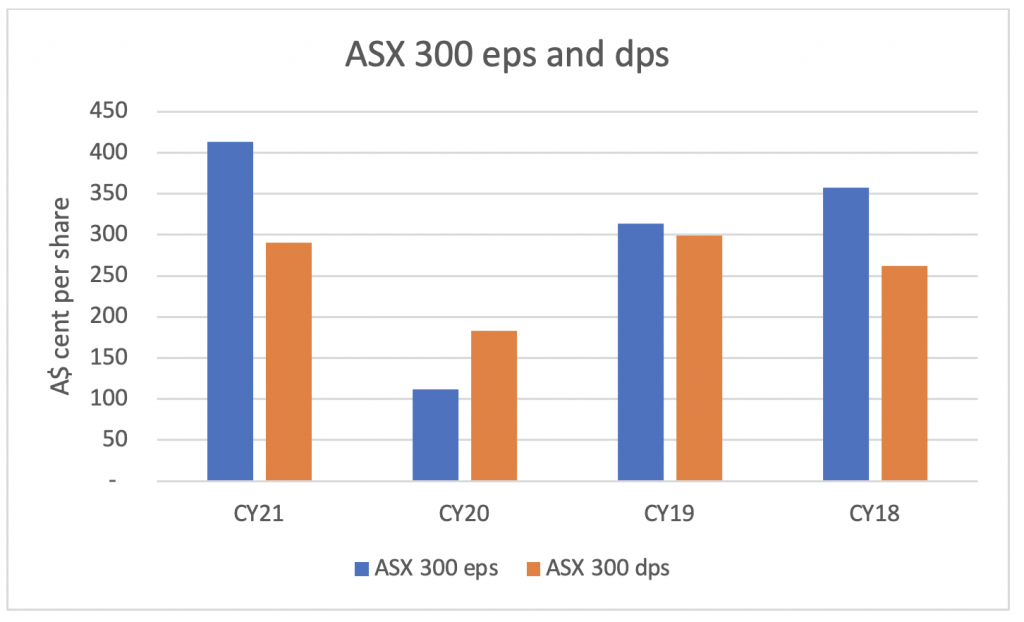

To see what the market’s earnings and dividend expectations are, let’s have a look at Bloomberg data for consensus earnings and dividends. As the first half of fiscal 2021 (second half of calendar 2020) was still impacted by COVID-19 lockdowns, I think it is more interesting to compare the calendar year-end forecasts as this gives a cleaner comparison as CY19 was not impacted by COVID-19.

If we first look at the chart below, which shows consensus earnings per share (eps) and dividend per share (dps) number for the full ASX 300 index, we can note some interesting points:

Source: Bloomberg

- CY21 eps are forecast to significantly exceed both CY18 and CY19 showing that the expectations are that the economy will come out in a stronger state post COVID-19 than it went in. This is probably not that surprising given the amount of stimulus money that has been created during the last 18 months which has to find its way to somewhere.

- We can also see that consensus is anticipating that companies will retain a higher portion of their profits than was the case in CY18 and CY19, which indicates that they want to continue to strengthen their balance sheets.

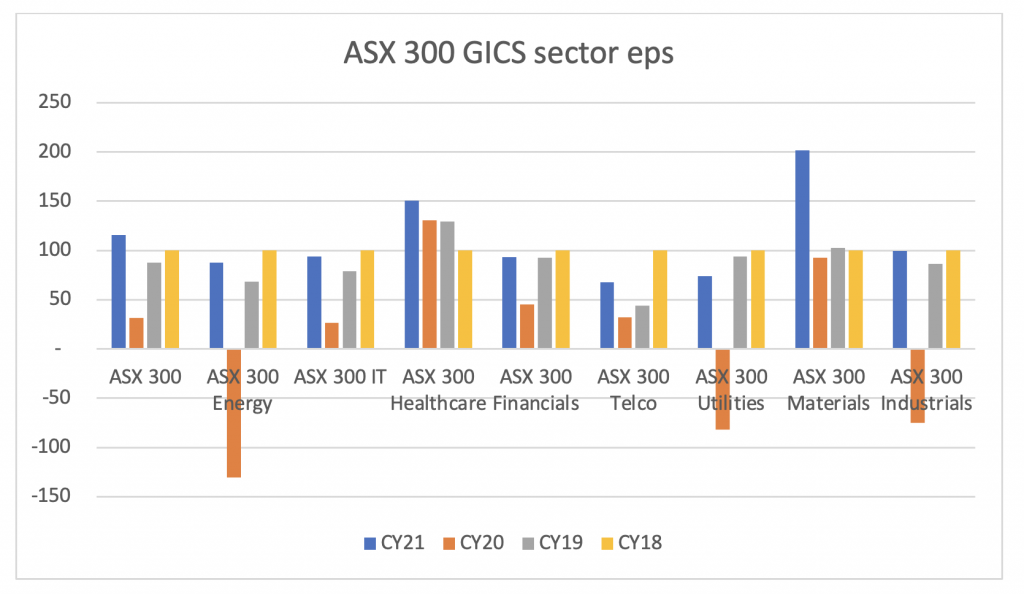

If we break down the data a bit further, we can draw some further insights from this next chart which shows the eps for the major sectors that make up the overall index:

Source: Bloomberg

- We can see that there is a widespread between the different sectors and, out of the eight sectors, only two are expected to generate higher profits per share in CY21 than in CY18.

- The Materials sector is the clear standout with CY21 eps expected to be more than 2x higher than in each of the preceding three years, which is a clear function of the record iron ore prices we are currently seeing.

- The Healthcare sector is also expected to grow its eps, which can be explained with company specific growth for CSL and Resmed and Cochlear seeing a return of activity after a steep drop during 2020.

- All other sectors are expected to see declining profitability vs. 2018.

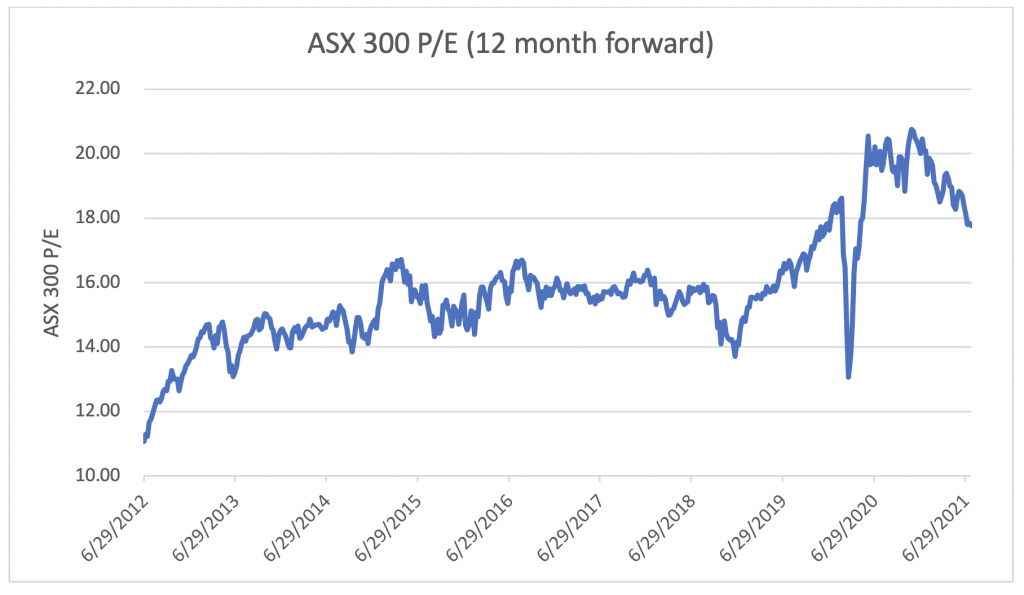

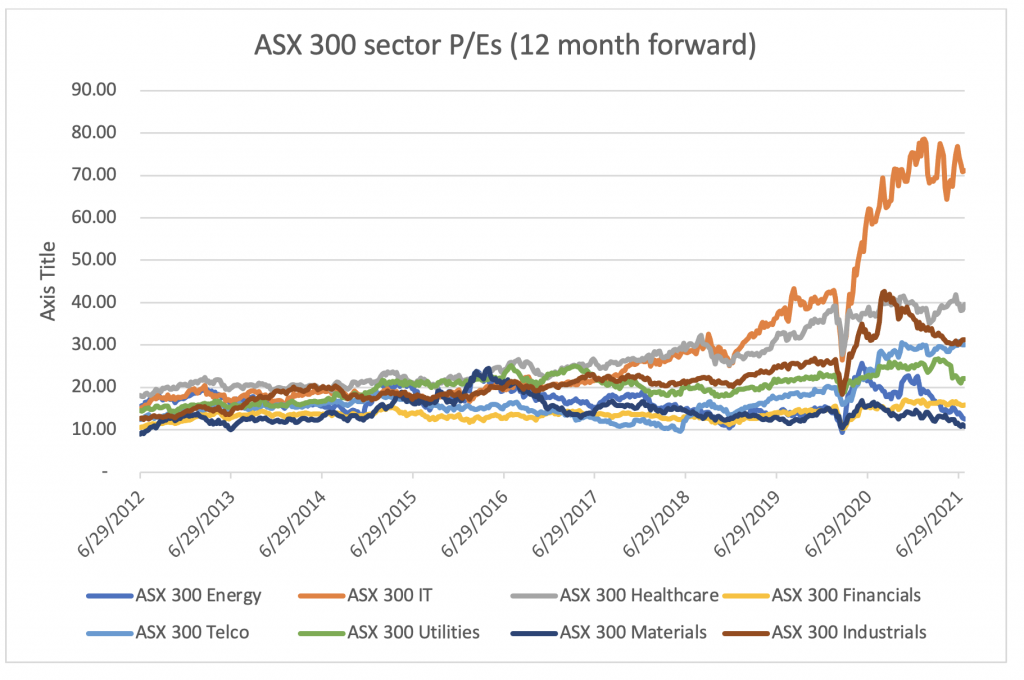

If we look at the market P/E and how it has developed we can see that even though we have seen a contraction recently from the absolute peak, we are still trading at quite elevated levels compared to the past and we should remember that the materials sector constitutes a larger part of the index than historically, and that the sector is trading at a significant discount to the other sectors, meaning that the other sectors are trading at even more elevated levels compared to history as the chart below shows:

Source: Bloomberg

Given what is happening in Australia at the moment with lockdowns affecting the major cities, it will be interesting to see how resilient the forecasts are for the full year and what direction revisions to forecasts we will see in the upcoming results.