Investor Insights

SHARE

Atlas Arteria says goodbye to the ‘silver doughnut’

Australian toll road operator, Atlas Arteria (ASX:ALX), has announced a new, simpler ownership structure that should benefit the company and its shareholders. The deal includes the separation from Macquarie Group – thus ending ongoing management fees to the ‘silver doughnut’ – and an increased stake in APRR, Europe’s fourth-largest motorway operator.

Atlas has investments in three different toll roads located in France, Germany and USA and started life as Macquarie Atlas. The company was started and managed by Macquarie Group but from 1 April 2019, it has been managed by an external management team but as the corporate structure is rather complicated (not unusual for Macquarie vehicles), Macquarie was still getting fees of around $15 million per year for managing Atlas’s stake in the most valuable asset, the APRR motorway in France where Atlas own 25 per cent.

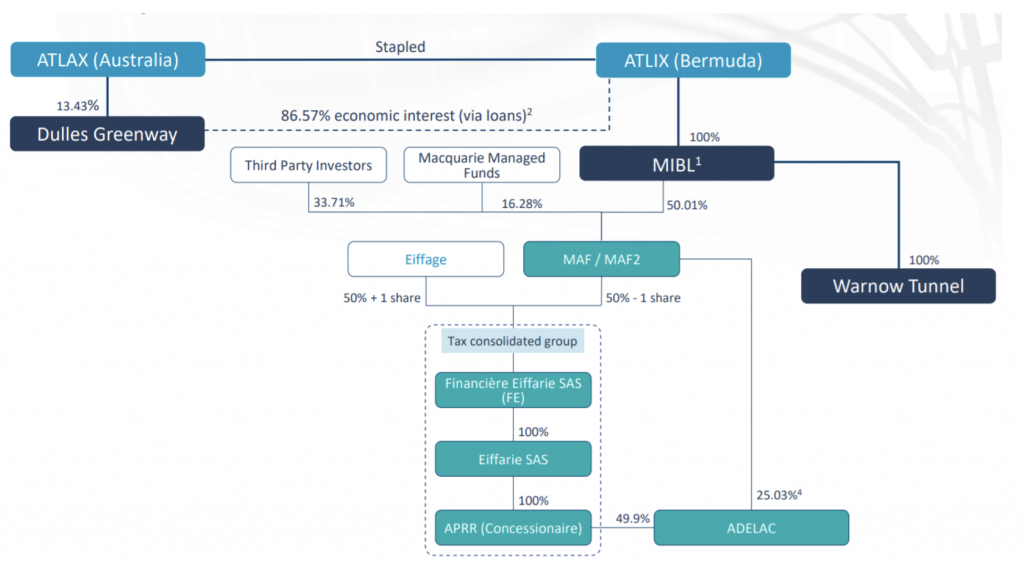

The new management team has been busy negotiating a complete separation from Macquarie. This has not been an easy task given the number of stakeholders involved. To get an idea, look at the organizational chart below:

I understand if you find this chart difficult to make sense of (it took me a LONG time to fully understand the intricacies) but for today’s purposes, let’s focus on the MAF/MAF2 box and its surrounding boxes and identify the key stakeholders involved.

Key Stakeholders

- MAF/MAF2 is an entity that owns 50 per cent (less one share) of the APRR motorway system in France.

- Eiffage is a listed French infrastructure company and is the operator of APRR.

- Macquarie Managed Funds are three different funds that together own 16.28 per cent of the MAF/MAF2 entity.

- Third party investors are two outside investors, ADIA or Abu Dhabi Investment Authority which is the sovereign wealth fund of Abu Dhabi, and PGGM a large Dutch pension fund.

- Not marked on the chart is Macquarie Group who as mentioned above receives an annual management fee from MAF/MAF2.

In total, this makes up six different stakeholders (counting Macquarie Group and the Macquarie Managed Funds as separate entities as there are different decision makers with different responsibilities involved). As anyone who has been involved in any negotiation knows, arriving at an outcome that satisfies everyone is not easy and the difficulty increases exponentially the more parties are involved!

My superficial outside assessment of the different parties’ main objectives is as follows:

Atlas Arteria:

- Wants to completely cut the tie with Macquarie and not have to deal with them when it comes to the management of MAF/MAF 2 stake

- Wants to be able to grow APRR through more investments

- Wants to increase its stake in APRR at the right price

- Wants to refinance APRR to delay debt amortization and free up more cashflow that they can either invest in other assets to distribute to share holders

Eiffage:

- Wants to be able to grow APRR. They have had to make investments outside APRR as the other shareholders in APRR have not been willing to put in more capital into APRR

- Wants to increase its stake in APRR at the right price

Macquarie Managed Funds:

- The funds are under pressure to exit as they are 12-13 years old and well past the time that they should have been wound up and returned funds to investors

- Wants to secure as good a price as possible for its stake in APRR

Third party investors:

- Want to maximise the value of their stake in APRR

- Might want to increase their stakes in APRR at the right price

- Probably share Atlas Arteria’s wish to refinance APRR and increase near term cashflow

Macquarie

- Wants to be compensated for the loss of management fees that giving up the management rights of MAF/MAF2 would result in

The situation is further complicated by:

- Eiffage has a call option on the APRR shares owned by MAF/MAF2 in the case that Macquarie seizes to be the manager of that entity

- The investors in MAF/MAF2 has pre-emptive rights to buy the shares in MAF/MAF2 if any of the other shareholders wishes to sell

As you can understand, this makes for a very complicated situation with many moving parts and many parties with varying motivations that need to be satisfied for a deal to occur. It is therefore very impressive to see the recent announcement that the new management team of Atlas Arteria has managed to negotiate a deal that we believe satisfies everyone including the shareholders of Atlas Arteria!

Atlas Arteria Deal

The deal structure in short is:

- Atlas will buy an additional 16.28 per cent stake in MAF/MAF2 and immediately on-sell a 4 per cent stake to Eiffage. This means that the third-party investors in MAF/MAF2 are giving up their pre-emptive rights to buy these shares and will result in Atlas’ effective stake in APRR will increase from 25 per cent to 31.14 per cent.

- Atlas will pay Macquarie $100 million in compensation for the termination of the MAF/MAF2 management rights which represents about 6.7x the annual cashflow.

- Atlas will also pay Eiffage $100 million for not exercising their call option over the APRR shares which they have the right to do as Macquarie will no longer be managing MAF/MAF2.

As far as we can see, this is a good deal for everyone and it is also something we think will be value accretive to Atlas Arteria’s shareholders.

The effective valuation that Atlas is buying the shares in APRR is around 10.3x EV/EBITDA which we think is very fair for the asset given the growth profile and remaining concession life.

Eiffage gets to increase its effective stake in APRR through its 4 per cent stake in MAF/MAF2 and also gets rid of the Macquarie Managed Funds which have been holding back further investments in APRR.

Macquarie gets compensated for the loss of management fees.

The Macquarie Managed Funds get closer to being able to wind up which will potentially trigger performance fees to Macquarie.

Third party investors do not see their stake in APRR go up but will likely benefit from an increased valuation of APRR as both the risk profile for the asset reduces with fewer stakeholders and the opportunity for further investments increased.

Overall, we see this as a good deal and congratulate Atlas management on negotiating it!

The Montgomery Fund and Montgomery [Private] Fund own shares in Atlas Arteria. This article was prepared 26 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Atlas Arteria you should seek financial advice.