Investor Insights

SHARE

Aura Private Credit: Letter to investors 04 October 2022

The Reserve Bank of Australia (RBA) monetary decision now has access to a key datapoint for their meeting today, with the first monthly CPI data (move from quarterly). We may be seeing some positive movement off the back of the RBA’s aggressive rate hiking cycle with household spending beginning to taper, although with inflation still on the rise the RBA will likely be driven to conduct further rate rises over the coming months.

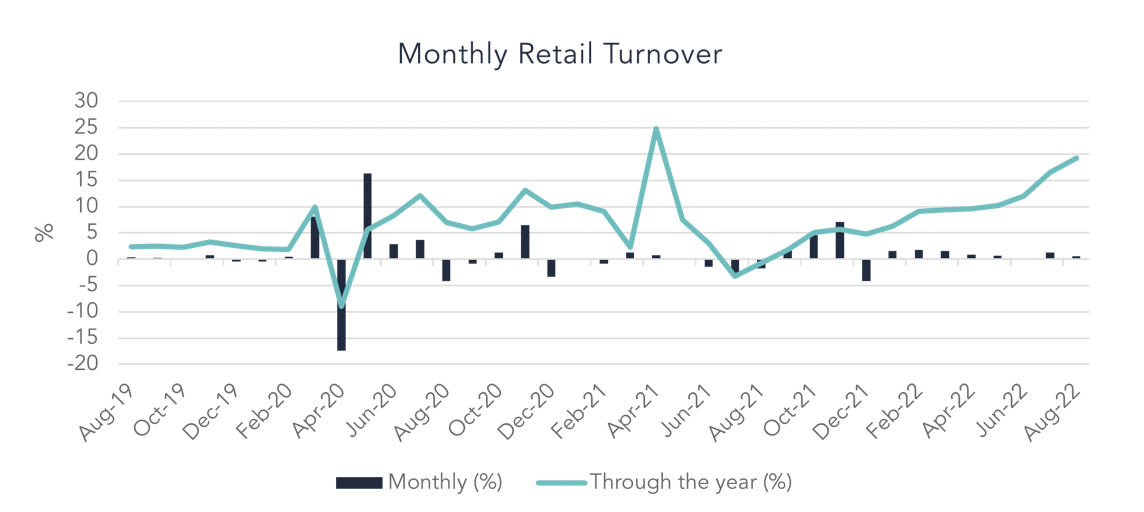

Retail Trade Remains Strong 1

Australian retail turnover rose by 0.6 per cent in August 2022 which makes this the 8th consecutive rise, despite the RBA’s best efforts to hamper spending and rein in inflation. In the year since August 2021 retail trade rose by 19.2 per cent. The data suggests that households are still yet to feel the full impact of this aggressive rate hiking cycle. The household savings buffer will likely continue to deplete as the ongoing effects of monetary policy begin to flow through.

Whilst the data shows households are continuing to spend, other retailing fell for the first time following five consecutive monthly rises, down 2.5 per cent with clothing recording its largest fall this year, down 2.3 per cent.

Australian National Accounts 2

In the June quarter, household wealth fell by $484 billion to $14,383 billion, a 3.3 per cent drop over the quarter. The ABS reported that this was the first quarterly fall in household wealth since the beginning of the pandemic. This result coincides with the high inflationary environment and corresponding measures being taken to reduce the heightened cost of living pressures via increased interest rates and also corresponds with the fall in stock market valuations.

Residential housing prices have also significantly slowed, contributing a 1.1 per cent drop to the overall decline in household wealth. The housing market is still expected to take a further hit, which would significantly affect household wealth and affordability.

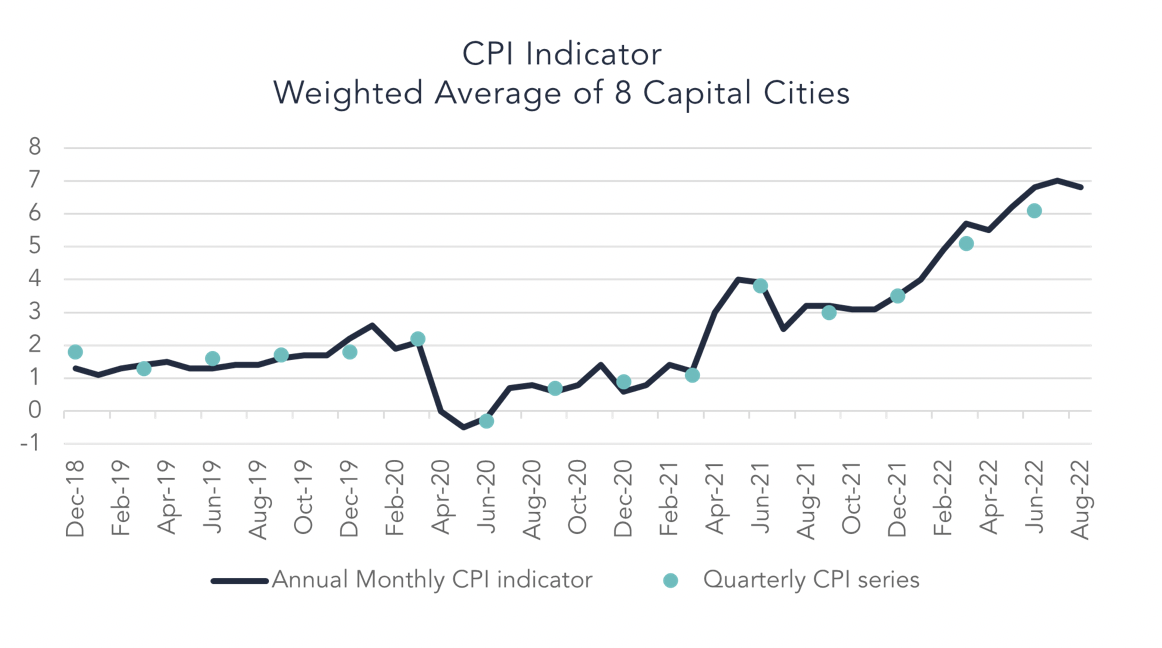

Monthly CPI Indicator 3

The ABS has begun reporting monthly CPI data from July 2022, in order to provide a more frequent inflation indicator that will assist the central bank in substantiating their monthly monetary policy decisions. The RBA has faced a significant challenge over some months and has been aggressively raising the cash rate for the purpose of reducing inflation, without seeing any real indication of how inflation has been responding.

The monthly CPI indicator rose by 7.0 per cent in the year to July 2022 and by 6.8 per cent in the year to August 2022. With more frequent data points to assess, the RBA will now have the ability to see how their monthly rate decisions are affecting financial and economic markets.

Over the 12 months to July 2022, the largest contributors were new dwelling construction, up 20.7 per cent and fuel up 15 per cent. The slight reduction in the annual inflation rate from July to August was predominantly due to the decrease in the price of fuel. With the fuel excise now over, this dip in inflation may not be truly reflective of the current environment.

Everyday items such as food and non-alcoholic beverages reported a rise in inflation up 9.3 per cent in the 12 months to August 2022. Fresh fruit and vegetables led the increase reporting a 9.1 per cent increase in June to 18.6 per cent in August. Pricing pressure remains high and this being one of the RBA’s key concerns will drive further rate rises.

Portfolio Commentary

The RBA monetary policy decision will be made today, and we anticipate another rate rise of 50bps, in line with market expectations. The persistent level of inflation and retail trade figures demonstrates to us that there is currently a lag and households are still yet to feel the real pinch from the rising interest rates.

We have seen that the Federal Reserve has continued to introduce aggressive rate hikes with the most recent 75 basis point rise bringing the cash rate range to 3 per cent – 3.25 per cent. The Federal reserve has indicated that further rate rises are anticipated.

The RBA faces an ongoing challenge in balancing the need to raise rates in order to reduce inflation, whilst also ensuring they do not create unnecessary pressure for households that could potentially result in a recessionary environment. Reports are showing a decline in household spending and wealth, which could imply that rates are beginning to have the desired effect, although we will need to see additional data come through in the coming months to substantiate this.

At the Fund level, loan demand remains strong from the underlying SME borrowers. The portfolio remains in good shape based on conversations with our lenders. We have been seeing strong borrowers entering loan assessment processes for our lenders, which, in our view is a further demonstration of banks not servicing the market.

1 Source: Retail Trade, Australian Bureau of Statistics, August 2022

2 Source: Australian National Accounts: Finance and Wealth, Australian Bureau of Statistics , June 2022

3 Source: Monthly CPI Indicator July and August 2022, Australian Bureau of Statistics