Investor Insights

SHARE

Aura Private Credit letter to investors: 04 August 2023

Over the last two weeks we have explored the different loan and security types of the Aura Private Credit strategies hold exposure to via relationships with non-bank lenders we see as best of breed. These lenders provide Australian small- to-medium enterprises (SME) with specialised funding solutions, utilising securitisation warehouse structures, provided by the Aura Private Credit strategies, as investment vehicles.

The loan and security types which the Aura Private Credit strategies hold exposure to through these vehicles include:

- Equipment & Machinery Finance

- Property (non-development) Backed Finance

- Livestock Finance

- Invoice Finance

In previous weeks we explored Invoice and Livestock Finance. This week we will take an in-depth review of Equipment Finance.

Equipment Finance: Supporting Capital Expenditure

If Small to Medium sized businesses are coined the backbone of the Australian economy, capital expenditure is the life blood. Capital expenditure is where a business spends to purchase, maintain or improve its fixed assets, such as equipment and machinery. Governments are typically supportive of capital expenditure, providing incentives during times of macroeconomic uncertainty, for instance, the Australian Federal Government’s Instant Asset Write Off Scheme.

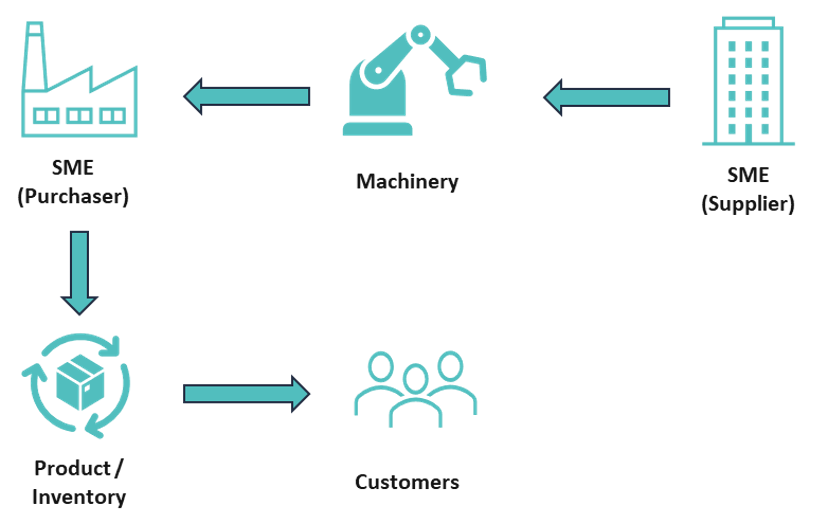

An SME purchases equipment or machinery from another, so that it can produce a product or inventory to be in turn, sold to customers. When this occurs, the supplier of the manufacturing equipment requires employees to assemble, maintain and sell the equipment and its components. The purchaser also requires employees to operate the machinery, finalise and eventually sell the product to market. This positive cycle increases economic activity and employment, allowing for government taxation revenue to be clipped at each step along the way.

Lenders play an enormous role in supporting capital expenditure within the economy since most companies don’t pay cash upfront for their equipment or machinery. Most will look to spread the cash outflows related to the purchase along the useful life of the equipment or machinery. If an asset is expected to support sales and generate cashflow over several years, it is logical for SMEs to pay for that asset over the same timeframe, using the increased revenue to support repayments. Equipment finance solves this problem for SMEs.

Because the equipment or machinery financed generally facilitate the generation of revenue, meeting repayments on equipment finance loans is a high priority for SME borrowers.

Equipment Finance: Security

Security Registration

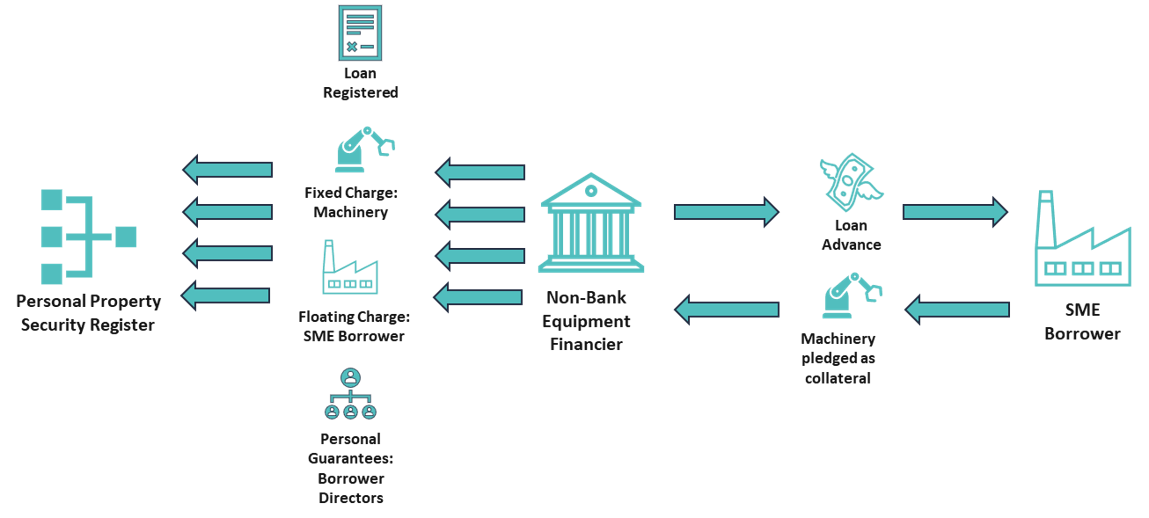

Australia possesses a robust framework for the registration of loans and collateral. The Personal Property Securities Register (PPSR) is an online database and centralised published record of loan agreements and any legal claims to property / assets used as loan collateral.

If a company borrows money and pledges an asset as collateral, a charge or lien is filed on the PPSR in order to ensure that:

- Other perspective lenders know that the borrower has credit outstanding, in case there was an attempt by the borrower to withhold that information; and

- That the particular asset in question is already encumbered and may not be pledged as collateral again to the same or different lender.

This ensures legal accountability around the lender’s security interests in the event of a loan default.

Fixed and Floating Charge

Non-bank equipment finance lenders that the Aura Private Credit strategies partner with register both fixed and floating charges on the PPSR.

The equipment or machinery financed by the SME borrower is registered as collateral for the loan and subject to re-possession by the lender should the borrower default. The equipment or machinery is unable to be legally sold while this registration is in-place. As a further layer of protection, equipment financiers will typically require that the asset be insured throughout the life of the loan.

The lenders also take a floating charge in the form of a general security agreement (GSA), which encompasses all other assets of the SME borrower not secured by a fixed charge. This is referred to as a floating charge as there are no strict impediments on assets covered by the general security agreement, so the value may fluctuate over time.

Finally, a Director’s Guarantee is also taken, a personal guarantee from the directors of the borrower in their personal capacity.

Loan to Value Ratio

Loan to Value Ratio is a key concept within equipment finance, as the equipment or machinery is the first and primary form of collateral should the borrower default on the loan.

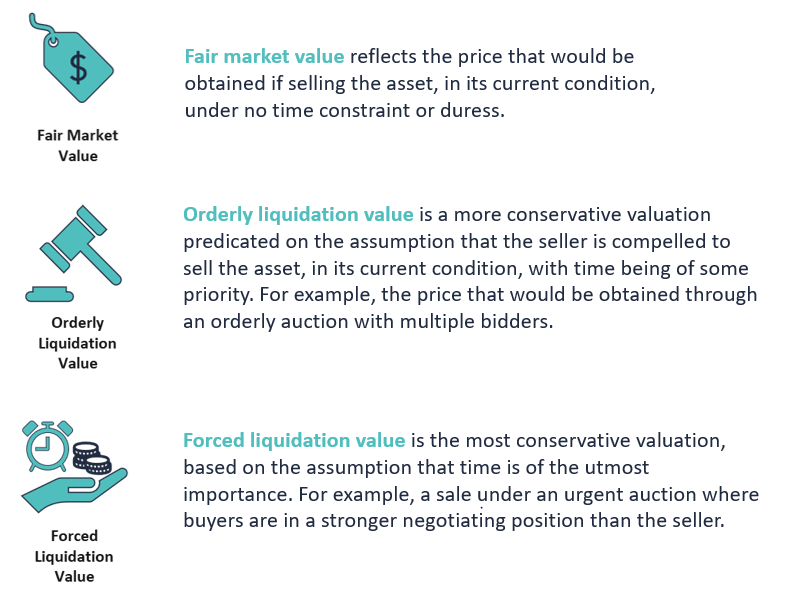

For brand new equipment the value assigned is typically the purchase price, with a depreciation schedule assumed for the asset. For secondhand equipment, an appraisal is important when assessing the collateral value of the asset. When an appraisal is done, three valuations are typically presented.

These include:

Equipment financiers will typically apply a maximum loan to value (LVR) against each of these valuations. Not advancing more than the forced liquidation value is viewed as a conservation risk appetite.

Equipment Finance: Example

- Loan Purpose: Purchase of a Revenue-Generating Crane Truck

- Borrower: Stellar Builders Pty Ltd

- Equipment: Heavy-Duty Crane Truck

- Loan Amount: $400,000

- Loan Duration: 36 months

- Interest Rate: 13 per cent per annum

- Collateral: The heavy-duty crane truck itself and a floating security charge over Stellar Builders Pty Ltd

Revenue Profile of the Asset: The revenue profile of the crane truck is driven by its essential role in the construction process. Stellar Builders charges clients a competitive rate for crane truck services based on the number of hours the crane is used. The company secures contracts with construction firms and developers, ensuring a steady stream of revenue throughout the loan tenure.

Serviceability Assessment

Stellar Builders Pty Ltd.’s financials and projected cash flows are thoroughly evaluated to determine the loan’s serviceability. The equipment financier assesses serviceability both on a historical basis, not accounting for any increased revenue produced by the financed asset; and on a forecast basis, building in the contracted revenues the crane truck will generate. Based on historical data and anticipated project pipeline, the projected cash flows demonstrate that Stellar Builders can comfortably service the principal and interest repayments with their current level of profitability. In addition, the anticipated revenue generated by the crane truck also more than offsets principal and interest repayments.

Projected Monthly Cash Flows (Including Revenue from Crane Truck Operations):

- Construction Monthly Revenue: $800,000

- Crane Truck Services Monthly Revenue: $50,000

- Total Monthly Revenue: $850,000

- Monthly Loan Repayment (Principal and Interest): $13,477.58

- Projected Monthly Net Profit (After Loan Repayment): $243,638.92

Valuation

An independent appraiser is engaged to assess the value of the heavy-duty crane truck. The appraiser provides the following valuations:

- Fair Market Value: $550,000 (73 per cent LVR)

- Orderly Liquidation Value: $500,000 (80 per cent LVR)

- Forced Liquidation Value: $450,000 (90 per cent LVR)

Registration of Security Interests

To secure the equipment finance loan, the lender registers on the PPSR a fixed security charge on the heavy-duty crane truck itself, ensuring that the asset serves as collateral for the loan. Additionally, a floating security charge is registered over Stellar Builders Pty Ltd, covering all present and after-acquired property assets, including inventory, accounts receivable, and other movable assets. These charges provide the lender with legal recourse in the event of loan default, mitigating their risk exposure.

Conclusion

The equipment finance loan empowers Stellar Builders Pty Ltd to acquire the revenue-generating heavy-duty crane truck, bolstering the company’s construction capabilities and revenue streams. The crane truck’s indispensable role in construction projects ensures a consistent flow of income, comfortably covering the loan’s principal and interest repayments. The comprehensive underwriting process, including the serviceability assessment, appraisal with three valuation scenarios, and the registration of fixed and floating security charges, provides a strong financial foundation for both the borrower and the lender.

The Aura Private Credit investment team view equipment finance favourably, both from a loan purpose perspective, enabling SMEs to expand revenue and productive capacity, aligning the purchase cost with revenues produced, and from a credit risk perspective, relying on three levels of risk mitigation:

- Insured equipment or machinery financed as a first level of collateral with security interests registered on the PPSR;

- Corporate and personal guarantees further securing the loan by the capacity of the SME borrower’s corporate entity and its directors in their personal capacity; and

- Credit enhancement at a structural level in the form of cash injected by the equipment financier which act as a first loss absorption piece, should the above levels of recourse prove insufficient.

We hope this week’s piece proves useful and insightful. We look forward to exploring Property (non-development) Backed Finance next week, in the fourth and final installment of the series.

You can view last week’s blog here:

Aura Private Credit letter to investors: 28 July 2023