Investor Insights

SHARE

Aura Private Credit: Letter to investors 18 November 2022

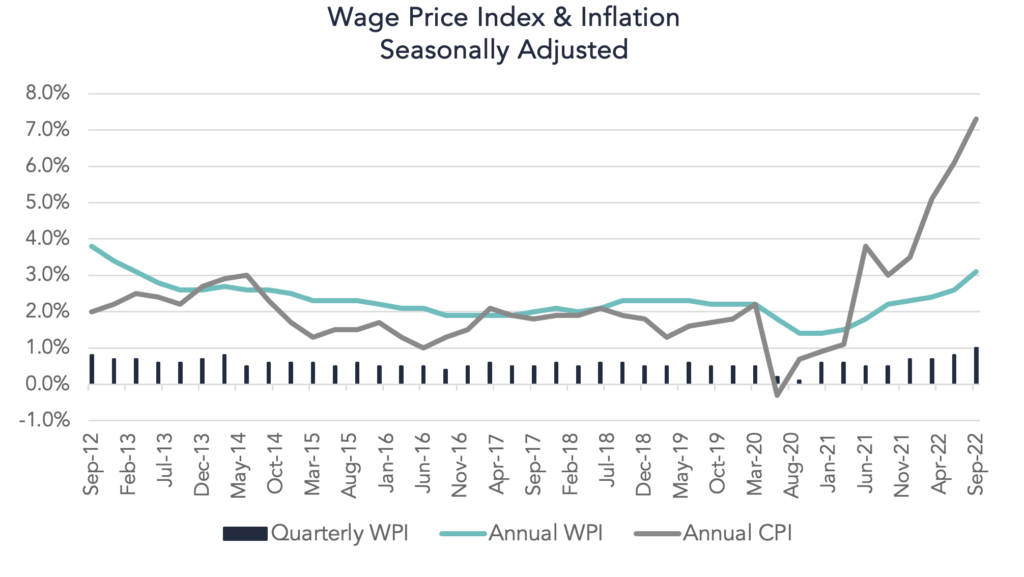

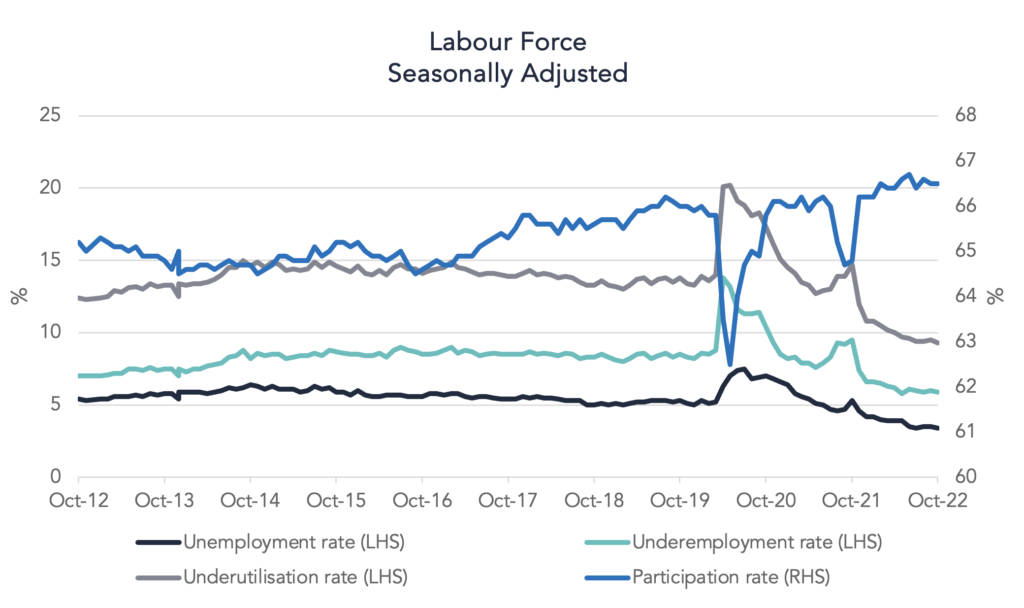

This week, the wage price index demonstrated that real wages are struggling to keep up with the rate of inflation. The labour force remains extremely tight, hitting a high point in 4 decades. With rates rising and migration coming back, we expect this to be close to the peak.

Wage Prices Index1

The seasonally adjusted wage price index data for the 2022 September quarter saw a:

- 1.0 per cent increase for the quarter.

- 3.0 per cent increase over the year.

- 1.2 per cent increase in the private sector.

- 0.6 per cent increase in the public sector.

A strong upward trajectory remains persistent in the Australia wage price index as illustrated in the graph below.

The ABS acknowledged that this is the highest quarterly growth in hourly wages that has been recorded since the 2012 March quarter. This quarters growth was predominantly driven by the private sector, outpacing the public sector rate of wage increases two-fold. As the labour market remains tight, and job advertisements remain unfilled, upward pressure on private sector wages continues. The public sector also saw an award increase widely delivered, with the Fair Work Commission introducing the largest award increase in over a decade. On an annual basis, the rate of growth at 3.1 per cent is the highest recorded since the 2013 March quarter. The private sector remained the strongest on annual terms with a 3.4 per cent increase compared to 2.4 per cent for the public sector. Despite this uptick in wage levels, the 7.3 per cent increase in prices over this same period resulted in a 4.2 per cent fall in real wages.

Labour Force2

Unemployment dipped back down to 3.4 per cent a 0.1 per cent drop for the month of October. The slight change was as a result of employment increasing by 32,000 people and the number of unemployed people decreasing by 21,000. The labour market remains extremely tight, and the underutilisation rate has dropped down to a 40 year low.

At a high level, the labour force reported the following statistics for the month of October:

- Participation rate remained at 66.5 per cent.

- Employment increased to 13,617,900.

- Employment to population ratio increased to 64.3 per cent.

- Underemployment rate decreased to 5.9 per cent.

- Monthly hours worked increased to 1,897 million.

Whilst the labour market remains tight, the rate of employment growth has begun to slow with relatively similar statistics being reported over the past few months and the level of unemployment remaining relatively stable at this stage. At this rate, the data illustrates that the labour market is likely operating at its limits.

Further easing is required in the labour market, before inflation begins to subside. Effectively, the tightness in the labour market coupled with persistent inflation is what is enabling workers to bargain for growth in wages. This data suggests that further rate increases are likely to come from the RBA in the coming months, until we begin to see a retraction in labour force participation and cost of living. Changes in the levels of skilled migrants entering Australia could be the catalyst for change.

1Australian Bureau of Statistics – Wage Price Index Australia, September Quarter 2022

2Australian Bureau of Statistics – Labour Force, October2022