Investor Insights

SHARE

Aura Private Credit: Letter to investors 28 April 2023

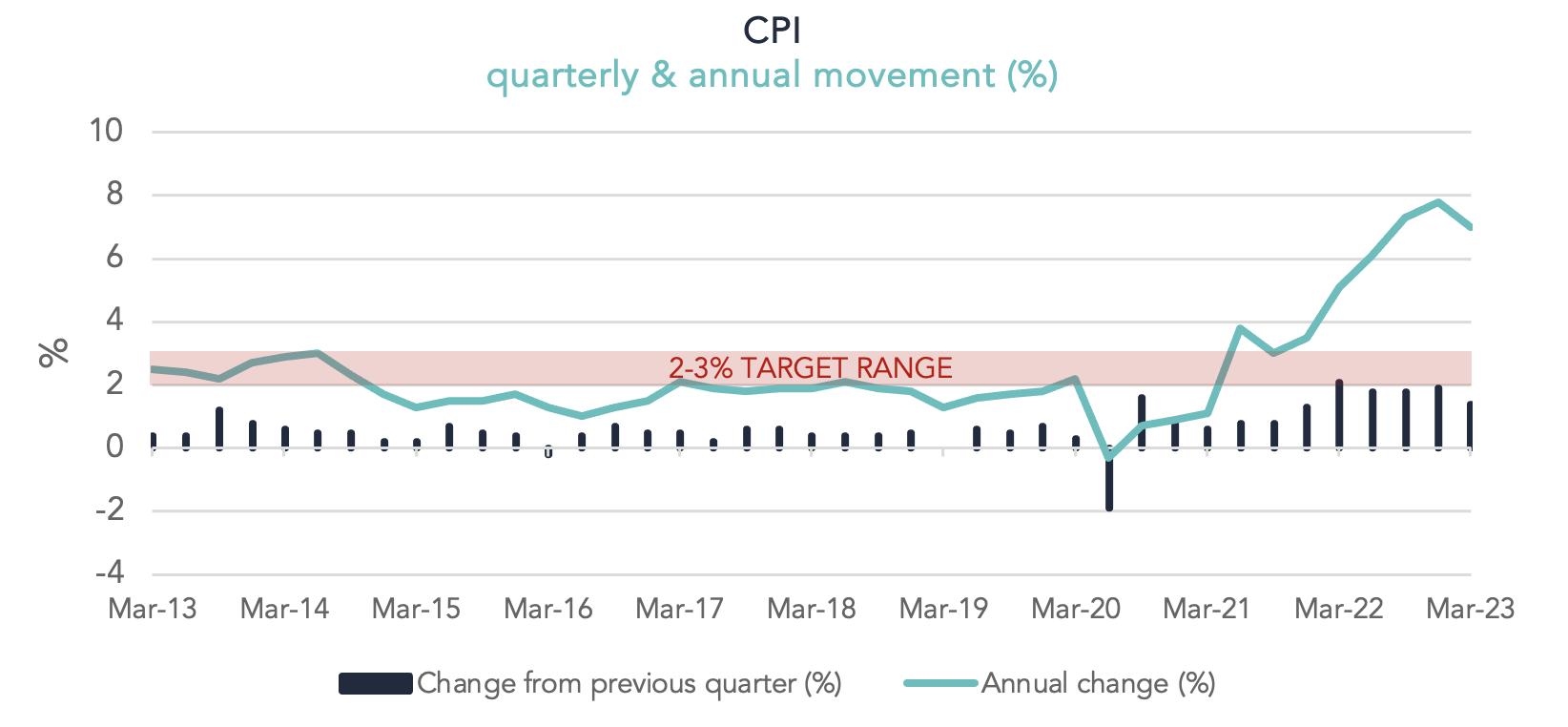

The Australian Bureau of Statistics (ABS) released the Quarterly Consumer Price Index this week, which confirmed a second consecutive quarterly slow down. The Reserve Bank of Australia (RBA) will be closely assessing this data in preparation for next weeks’ monetary policy decision meeting.

Consumer Price Index, March 2023

The 1.4 per cent quarterly rise to 7 per cent for the March 2023 quarter, is the lowest quarterly rise reported since December 2021. This is welcome news and demonstrates a trend in the right direction, although there is anticipation that an upward shift in the interest rate is yet to come.

Whilst prices across goods and services are continuing to rise, the increases were smaller than they have been in recent quarters, demonstrating the desired slow down is beginning to flow through. The main contributors to this quarter’s figures were:

- Medical and hospital services were up 4.2 per cent in line with annual fee reviews.

- Tertiary education was up 9.7 per cent in line with indexation.

- Gas and other household fuels were up 14.3 per cent following price reviews. As we enter Winter, the expectation is that electricity prices will increase sharply in the September 23 quarter, potentially affecting the slowdown in inflation we are currently experiencing.

- Travel and accommodation up 4.7 per cent.

The economy as a whole is proving resilient, consumer spending and the rate of unemployment continues to hold up strong, implying that the RBA is likely to introduce a further rate hike. Their previous communication has implied that they are willing to introduce further rate hikes off the back of the data on household spending, inflation and the labour market. With these all holding at strong levels, we as an investment team are bullish on their being further uplift in the cash rate.