Investor Insights

SHARE

Australian SMEs, non-bank lenders, private credit funds & securitisation

The Reserve Bank of Australia provided an update on its “Recent Developments in Small Business Finance and Economic Conditions” series in the September 2023 bulletin1. The update touches on both the contribution of SMEs to the Australian economy and their access to finance (particularly small businesses), via traditional ADI (bank) funding and non-bank funding. The RBA paper makes reference to the Productivity Commission’s “Small business access to finance: The evolving lending market”, research paper2 which highlights the role of private credit funds, such as the Aura Private Credit Funds, in the provision of capital to non-bank lenders through securitisation warehouse facilities.

Contribution to the Australian economy

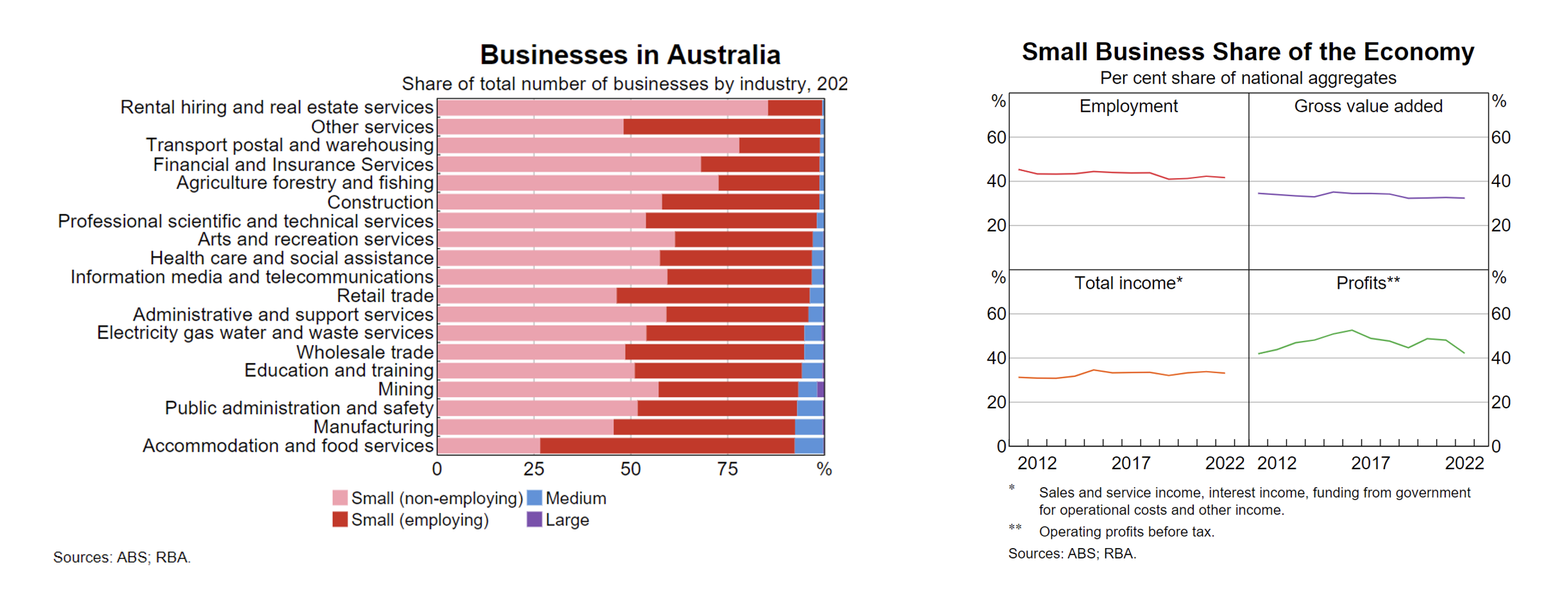

There are around 2.6 million businesses in Australia. The vast majority of these – 97 per cent – have fewer than 20 employees, which the Australian Bureau of Statistics (ABS) uses as its definition for a small business. Small businesses make up a large share of businesses across all industries.

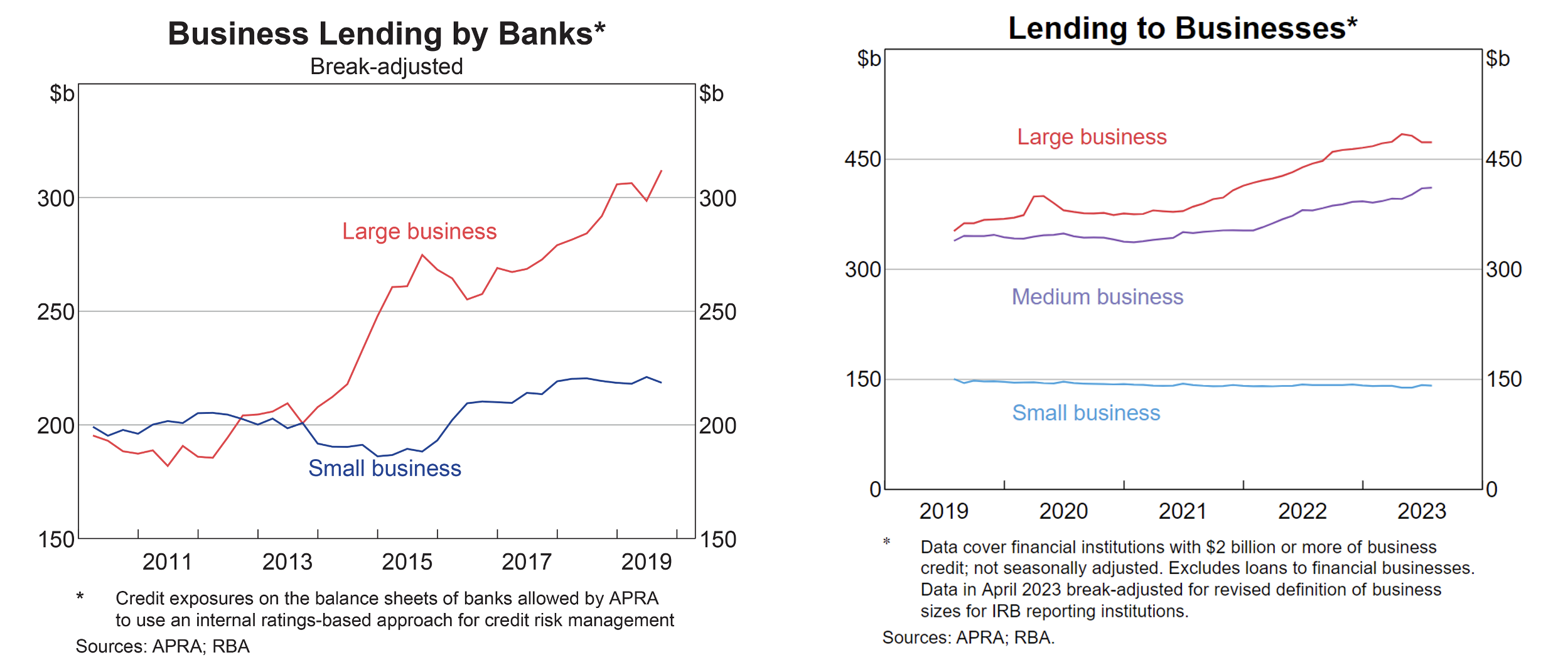

(Difficulty) accessing finance – traditional banks

“For many years, small businesses have reported that they find it difficult to access finance from traditional lenders with terms that suit their needs. A recent survey of SMEs found that around half had faced difficulties when trying to obtain funding, with the most common challenge being the time taken to process applications”.

“The requirement to provide residential property as collateral has long been cited as the key constraint on access to finance for some SMEs”.

Accessing finance – non-bank lenders

Non-bank lenders have emerged as a solution to small and medium sized businesses seeking debt capital, acknowledging security forms other than the residential property of the SME directors. The forms of security that non-bank lenders that the Aura Private Credit Funds work with include:

- Equipment & Machinery Finance

- Property (non-development) Backed Finance

- Livestock Finance

- Invoice Finance (credit insured)

The RBA report identifies that these lenders “commonly use technologies to assess creditworthiness and allow SMEs to access finance more quickly than through banks” often drawing data from businesses bank and accounting platforms.

Non-bank lenders are typically managed by tenured industry professionals who specialise in a single security form or funding solution.

Non-bank lenders have materially improved SMEs access to finance and expanded available loan types beyond the traditional residential property secured or unsecured options.

Non-bank lenders access to finance – Private credit funds & securitisation Warehouses

Unlike traditional banks, non-bank lenders are unable to raise capital through term deposits. Non-bank lenders, particularly those who lend to small and medium sized businesses, utilising specialised forms of security, turn to securitisation warehouse facilities provided by private credit funds to fund their loan originations. There are only a handful of private credit fund managers with the specialised knowledge and capital required to underwrite and fund these facilities, resulting in a complexity and scarcity premium for investors in these funds.

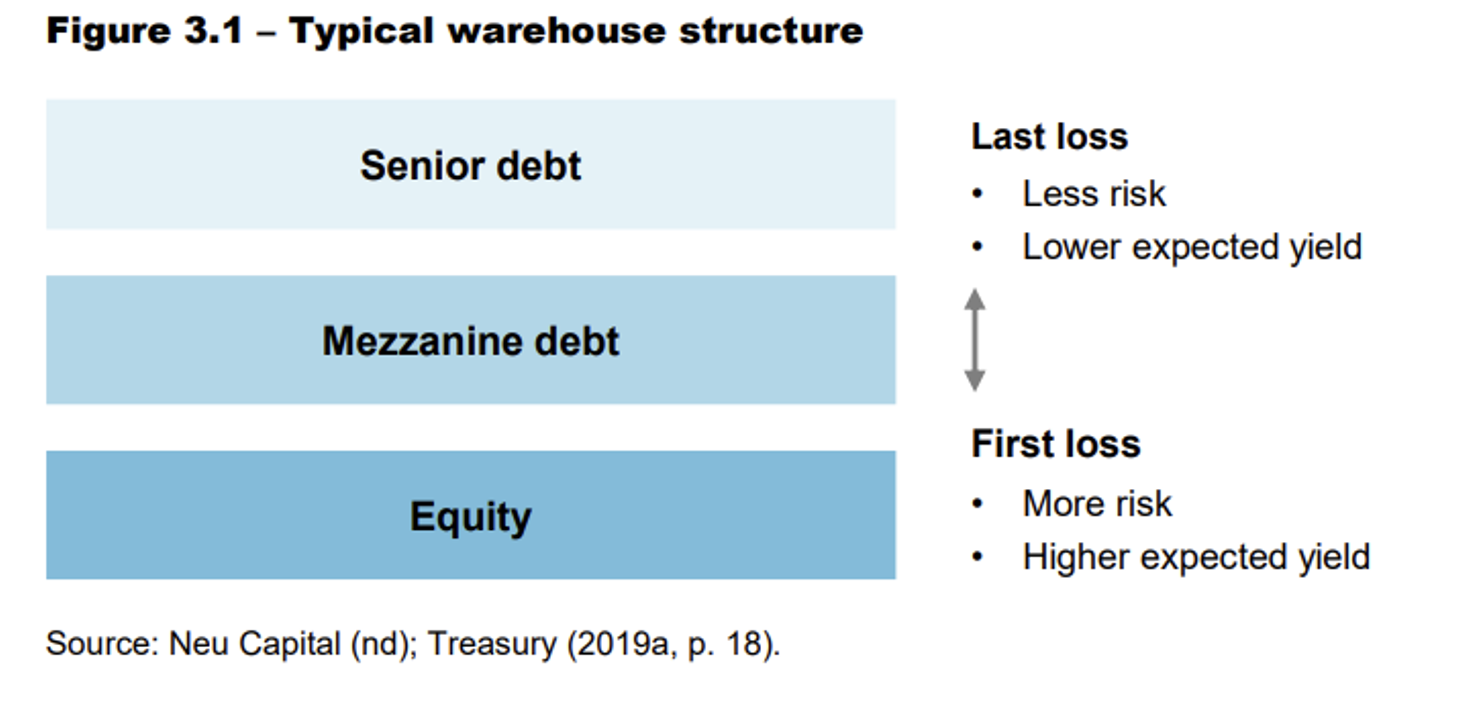

As described by the productivity commission “Warehouses are structured with tranches of varying degrees of subordination — that is, protection from losses — and typically include:

- a senior lender that is relatively protected against credit risk

- subordinated mezzanine investors

- the SME loan originator holding about 10–30 per cent equity in the facility so that they bear the first risk of any losses.

Securitising a large number of small SME loans provides greater granularity in the underlying pool of assets that back the security, which improves diversification and can therefore be more attractive to investors”

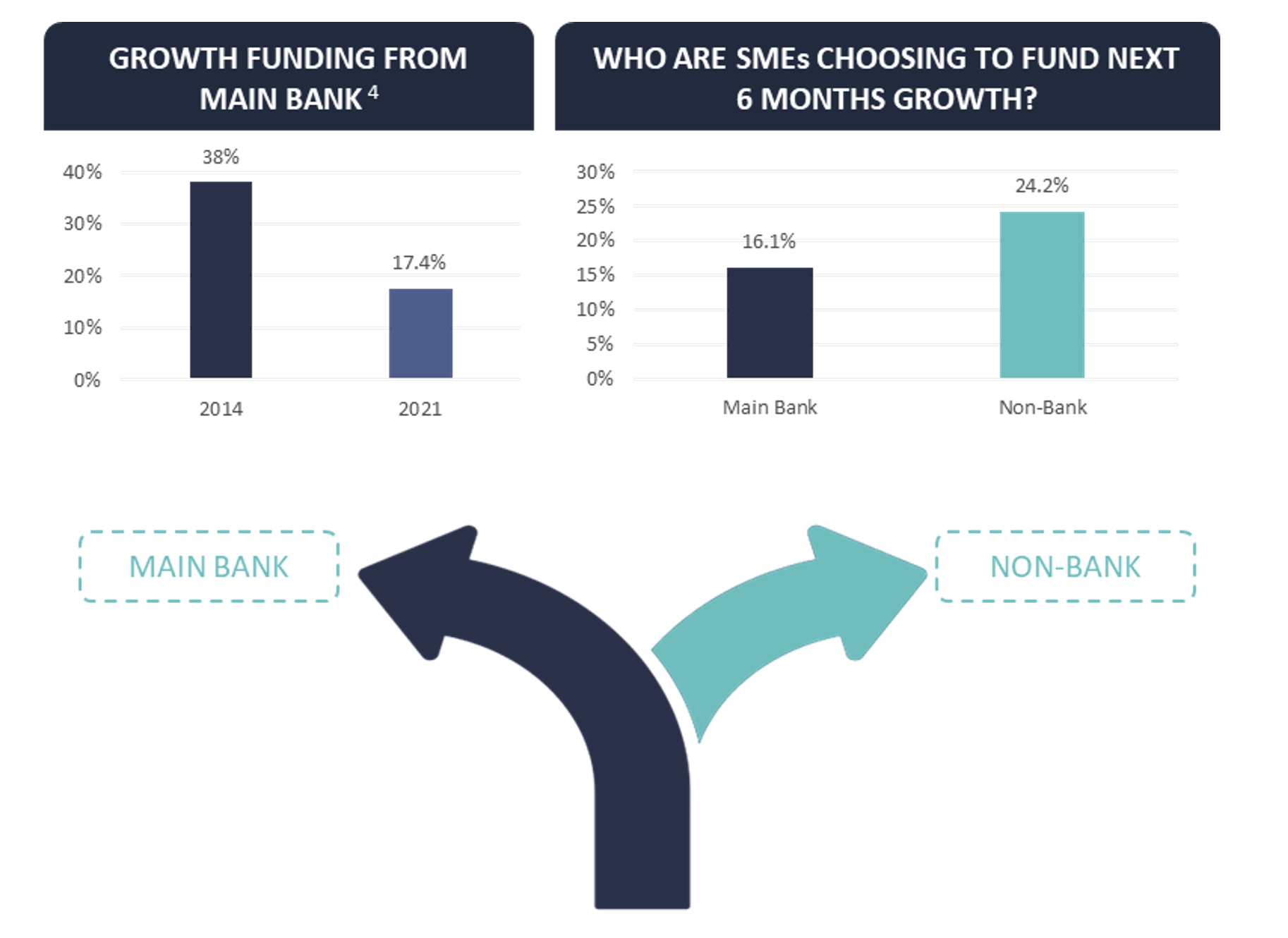

An expanding market

“Between 2016 to 2018, about $4 billion of deals backed by secured SME loans were issued.” Since 2018, the trend towards the use of non-bank lenders by SMEs has continued. According to Scottish Pacific’s 2021 SME Growth Index3 “One in 12 SMEs has already added non-bank funding facilities and a further 1 in 8 small businesses plan to add non-bank funding facilities in 2021.”

Investors will continue to benefit from the investment opportunity driven by this expanding market. As is the case for fund managers underwriting securitisation warehouse facilities, it is important for investors to consider a number of factors when assessing a private credit fund, including:

- the investment teams’ experience and specialisation in their chosen investment type;

- tenure and track record; and

- experience managing portfolios through trying economic times, such as the COVID induced recession and lockdowns.

1 Recent Developments in Small Business Finance and Economic Condition – RBA Bulletin, September 2023

2 Small business access to finance: The evolving lending market – Productivity Commission Research Paper

3 Scottish Pacific Business Finance 2021 SME Growth Index