Investor Insights

SHARE

Could equities give back some of their 2023 gains?

If the headline didn’t grab your attention, that’s probably because you thought it was about interest rates. In fact, it’s about the equity market itself.

On August 18, in this blog post, I noted, “…achieving the Fed’s two per cent inflation target remains a challenge, and while there are projections for another Fed rate hike at the September meeting, followed by a slower rate-cutting cycle over the next few years, progress on inflation may remain problematic and cause bouts of equity market volatility.”

In that post , I also noted, “Elsewhere, U.S. treasury yields are again above four per cent. At the time of writing, U.S. 10-year treasury bonds are back to 4.107 per cent. While they briefly touched this level in March and July, the last time they traded above this level was in October and November, last year, when the equity market was on its knees.”

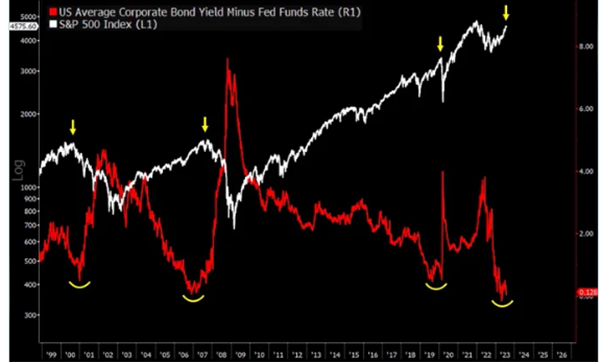

Meanwhile, corporate bonds now yield only 0.12 per cent more than the Fed funds rate. As Figure 1 reveals, since the turn of the century, every time credit spreads were at such suppressed levels, an equity market sell-off transpired.

Figure 1. Corporate bond yields versus Fed Fund and S&P500

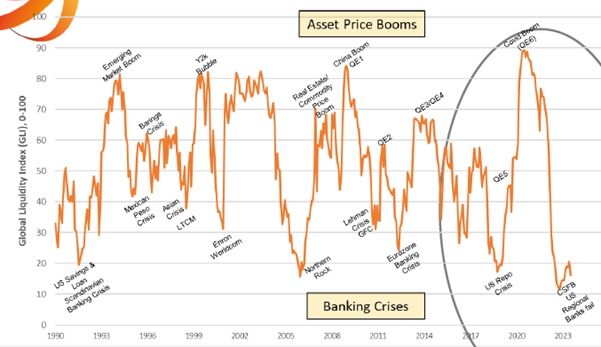

More recently, Crossborder Capital, the UK-based research firm that follows global central bank liquidity – think Quantitative Easing (QE) and Quantitative Tightening (QT) – observed their Global Liquidity Index had pulled back to a low of 16.5. Figure 2 puts the level in context.

Figure 2. Crossbroder’s Global Liquidity Index.

Source: Crossborder Capital

You’ll note low liquidity index levels coincide with a variety of financial misdemeanours and crises. Most recently, it was the rescue or backstopping of U.S. Regional Banks and UBS’s purchase of Credit Suisse that marked the banking turmoil normally associated with low levels of liquidity.

Whether there’s more to come remains to be seen, and low index levels sometimes coincide with challenging equity market conditions. But not always. Between 2018 and early 2020 Crossborder’s index sat below 20, and we all remember how the U.S. S&P500 rallied 20 per cent and the Nasdaq Composite rallied 31 per cent between the beginning of 2018 to just before the Covid Pandemic emerged.

Moreover, CrossBorder Capital notes in their August note, “Leading indicators point to a coming turn upwards in the business cycle. We continue to believe that most of the economic slowdown is already behind us…World business confidence and an index of World shipping activity, both of which similarly signal an inflection.”

The researchers then add, “we hold to our strategic view that the Global Liquidity cycle bottomed last October and will not peak until early 2026.”

CrossBorder’s analysts also note, “We have held a bullish view towards equities for several months because Central Banks have been adding back liquidity and inflation has fallen. Equities enjoy low inflation, and they are hurt far more by higher inflation than by higher bond yields. However, we cannot dismiss the indirect negative impact of bonds on stocks that comes via the liquidity channel and collateral.”

Given the NASDAQ100, for example, has risen over 40 per cent this calendar year to date alone – something we suggested was possible for 2023, back in November last year – the combination of low levels of central bank liquidity, very high ten-year bond rates, and very narrow corporate bond premiums, some profit-taking might be warranted, for those willing to take the risk of reducing their exposure to the market and being wrong about the market declining.

In May and October last year, I added to my investment in global small caps, believing innovative growth stocks would be the beneficiaries of the combination of disinflation and an economic growth rate that might be anemic but could nevertheless be positive. I got the goldilocks combination of disinflation and positive economic growth right, and this is a combination that has long been supportive for the prices of equities, especially the most innovative growth companies.

As it turns out, it wasn’t small cap innovative growth stocks that benefited. It was the largest of seven innovative growth companies in the world that took flight. Companies like Amazon, Apple, Microsoft, Google et. al. surged amid excitement about the transformational power of AI.

With that excitement waning a little, the end of the current reporting season could result in attention turning back to the macroeconomic picture, the still low levels of global liquidity, as measured by CrossBorder Capital’s index, and the relatively high ten-year U.S. Treasury bond rates. Some profit-taking may emerge.

It’s next to impossible to time the market correctly, and there is enormous evidence that jumping in and out of stocks produces inferior results. Nevertheless, I can appreciate why some investors are nervous about the short term, as am I.

Crossborder appear to be sitting on the same fence, noting, “Strategically [read, ‘longer-term’], we continue to favour monetary inflation hedges and a full weighting towards equities, with the tactical [read, shorter-term] caveat that near-term we suggest stepping back from risk markets.”