Investor Insights

SHARE

Four implications of a falling Aussie Dollar

Over the past year, the Australian dollar has fallen against the US dollar. It’s a trend I don’t expect will change any time soon. This has important consequences for many Australian businesses and for investors.

Just over a year ago, I published a blog post looking at what had happened during the previous year in terms of currency movements. Given it is now becoming clear that the RBA will start cutting interest rates again and there is generally a very clear correlation between interest rates and currency movements (see the theory of Interest Rate Parity), I thought it would be interesting to revisit the analysis and see what has happened in the last year.

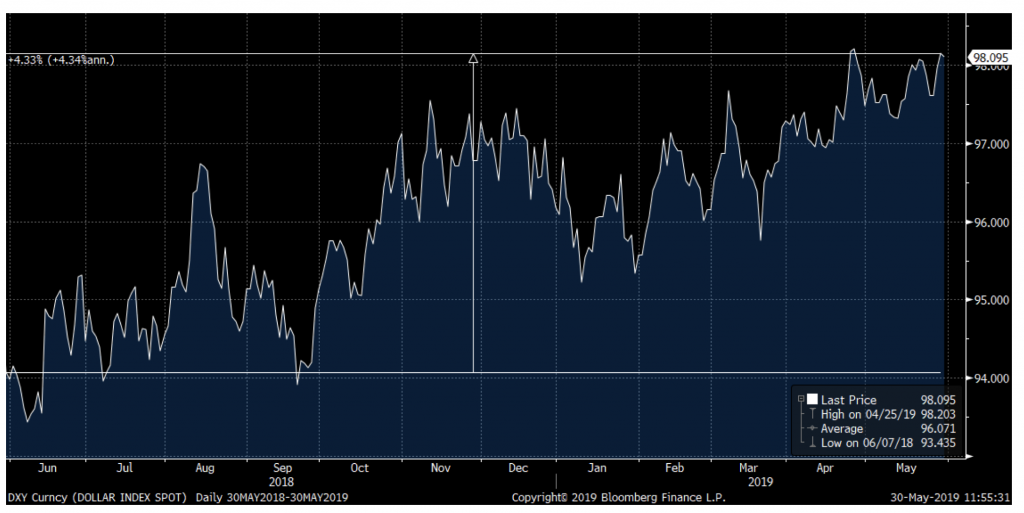

To recap, when I wrote the last update on currency movements, the US dollar had dropped by about 10 per cent over the preceding year compared to a basket of the world’s other major currencies (the DXY index). We can see this has steeply reversed, and the US dollar has instead increased by a bit over 4 per cent since my last post which is to be expected given that the Federal Reserve increased US interest rates three times during the period to December 2018:

Source: Bloomberg

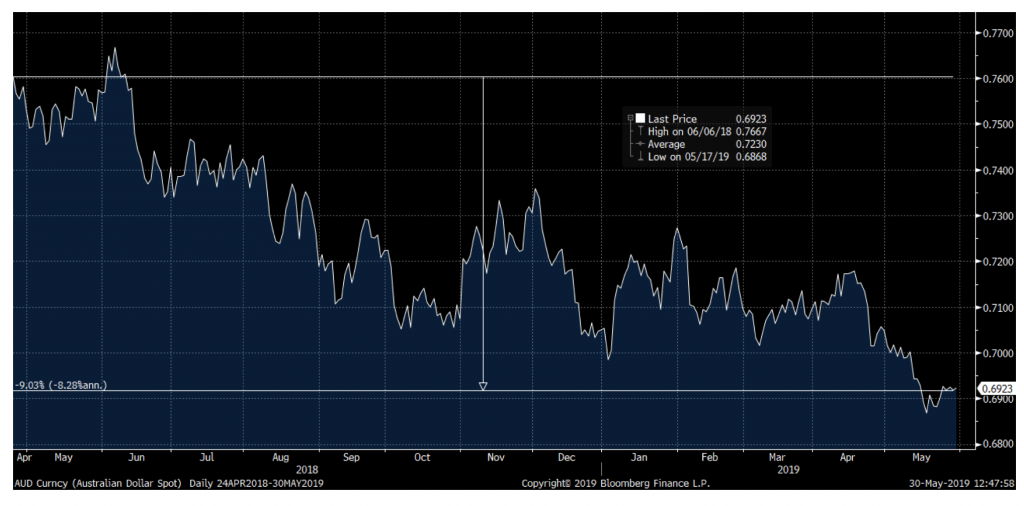

If we now look at how the Australian dollar has performed compared to the US dollar during the same period, we can see that it has fallen by about 9 per cent:

Source: Bloomberg

This is to be expected given the interest rate increases in US and the increasing expectation that the RBA will have to cut interest rates.

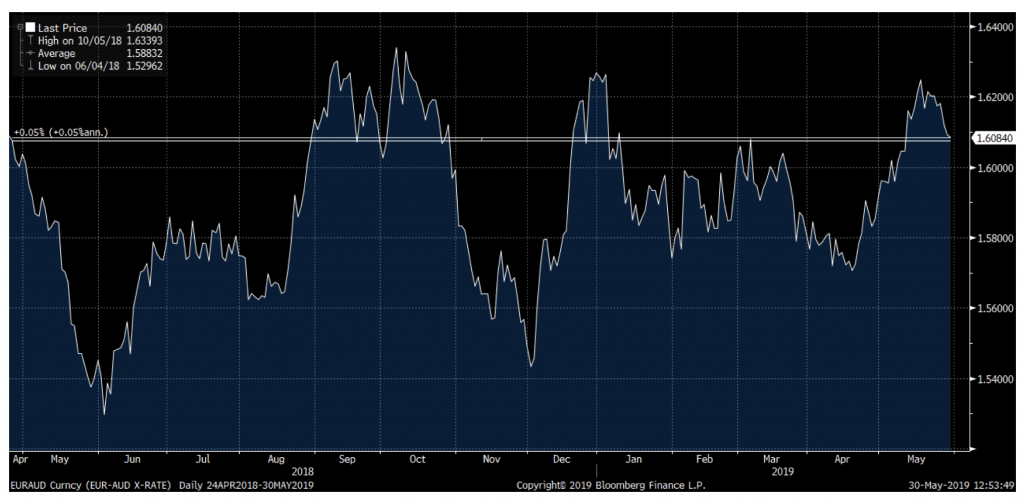

If we compare to the Euro, we can see that there have been some ups and downs during the period but that overall the exchange rate is roughly the same as when I last wrote about it:

Source: Bloomberg

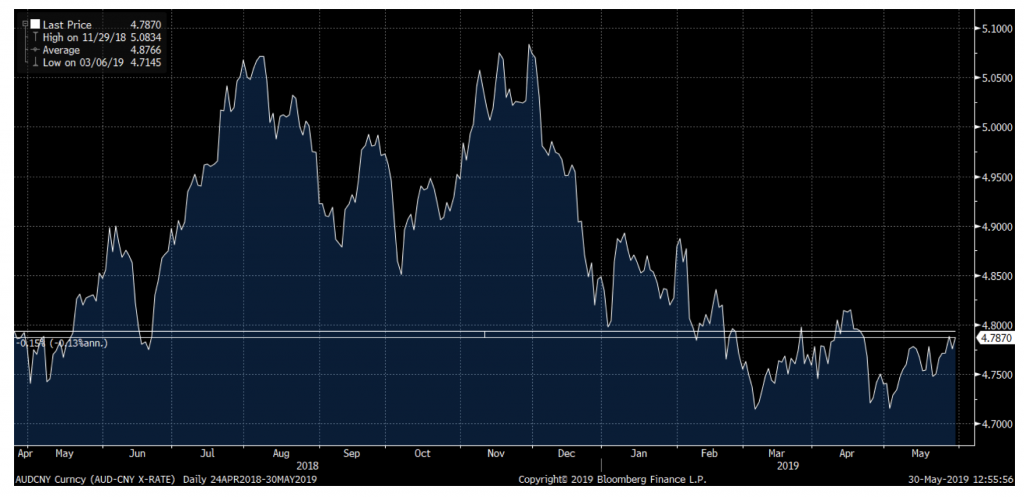

The picture looks quite similar when we compare the Australian dollar to the Chinese Yuan – after some ups and downs, we are at very similar levels as last year:

Source: Bloomberg

The implications for companies are the same as I wrote a year ago:

- For companies that have a mismatch between their currency base of revenues and costs, changes in the value of currencies can have quite significant negative or positive impacts on margins. If you are an export-oriented company with manufacturing in Australia (not so many of those left unfortunately) and the value of the AUD goes up vs the currencies you sell your goods in, you will most likely see a squeeze on margins. Conversely, if the AUD goes down, your margins will benefit. If you are a company that is focused on imports, you will experience the reverse effect. This can of course be impacted by any hedging you undertake but the fundamental direction should still be the same. Since most companies are valued with some reference to their earnings power, changes in currencies will impact the share price. Long term changes in currencies will also have a long-term impact on the relative competitiveness of different companies and industries.

- For companies with borrowings in different currencies, changes in the value of those currencies will impact the value of the debt that will eventually have to be repaid and hence have an impact on the share price as the value split between equity and debt will change.

- There are some companies that are dual listed and where the primary listing is not in Australia. The share price for these companies is generally set in the foreign currency and any changes in currencies should translate directly to the value of the Australian listed shares.

- Commodity prices are generally set in USD, and companies that are either producers of commodities or heavy users of commodities are hence directly impacted by changes in currencies.

In The Montgomery Fund, we are continuing to be defensively positioned and are generally overweight export oriented companies compared to the overall index as we do not see that the interest rate differential with the US will start to reverse any time soon.

Over the past year the Aussie dollar has fallen against the US dollar, and considering a very clear correlation between interest rates and currency movements it’s a trend that may not change any time soon. Click To Tweet