Investor Insights

SHARE

Is Challenger undervalued?

The share price of Challenger Limited (ASX: CGF) – Australia’s leading annuities provider – has declined by almost 50 per cent in the past 12 months. While the firm is clearly out of favour, I believe its long-term prospects could be better than the market is currently pricing in.

Readers will surely be aware that conditions have been tough for this business of late, with sales of annuities coming under pressure. Here is how Challenger put it when they reported in recent days:

Here is how Challenger put it when they reported in recent days:

- “Life relies on third party financial advisers, both independent and part of the major advice hubs, to distribute its products. Following the public hearings and completion of the Royal Commission into Misconduct in the Banking and Financial Services Industry (Royal Commission), there has been significant disruption across the Australian financial advice market which has reduced customer confidence in retail financial advice and reduced the acquisition of new customers by third party financial advisers. The financial advice market disruption has impacted Australian wealth management industry sales, with the March 2019 quarter being the lowest quarter in 15 years for retail flows.”

Readers will know that a core part of any investment we make is to map the relationship between the stock price of business and the implied expectations for the key value drivers of the business. Only when we know what is currently priced in can we make a determination over the extent to which these market-implied expectations are reasonable, or otherwise.

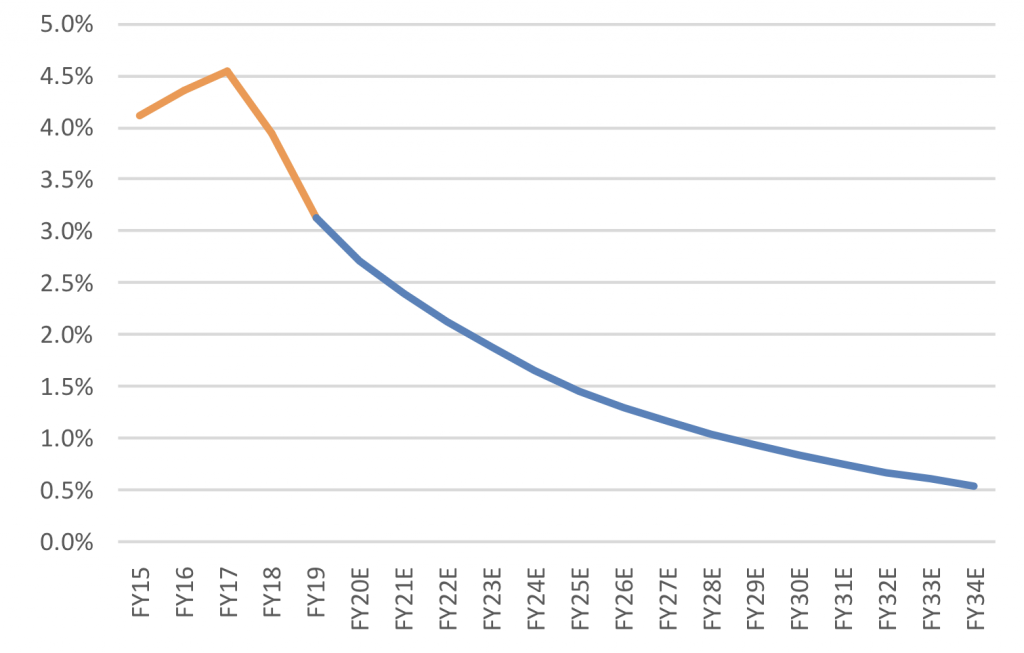

The chart below shows our estimates for the approximate market-implied trajectory of the ratio between: (i) retail annuities sold by Challenger each year; and (ii) the annual flows into the Australian post-retirement space, from the accumulation space. By “market-implied”, we mean the trajectory of this ratio being priced in to Challenger’s current stock price.

Market-implied expectations for Challenger’s share of post-retirement flows

Source: MGIM estimates

As you can see, the current stock price of Challenger is basically saying that annuities will capture a declining share of the flows moving into post-retirement each year, forever. And who knows? Maybe this will turn out to be true. But if annuities end up playing a more significant role in the portfolios of Australian retirees then, under this scenario, the current expectations being priced into the stock are far too conservative. Said another way, under the scenario, the stock is materially undervalued.

The Montgomery Global Funds and Montaka own shares in Challenger. This article was prepared 15 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Challenger you should seek financial advice.