Investor Insights

SHARE

Time for small caps to shine

In my final video insight for the year, I wanted to share some potentially exciting news for all you small cap stock enthusiasts out there. I delve into the recent developments at the U.S. Federal Reserve and what they mean for small cap stocks. Will 2024 be the year for small caps?

Transcript:

Hi, I’m Roger Montgomery and welcome to this week’s video insight, our last for 2023. Today, we have some potentially exciting news for all you small-cap stock enthusiasts out there. In this video, we’ll be discussing the recent developments at the U.S. Federal Reserve and what they mean for small-cap stocks. I think 2024 might just be the year of the Small Cap! So let’s dive in.

Last week, the U.S. Federal Reserve took an unexpected turn in its policy rhetoric, and it’s causing quite a buzz in the market. They’re talking about the possibility of three rate cuts next year or a threequarters of a per cent reduction in rates next year. Now, this is significant, especially for small-cap investors.

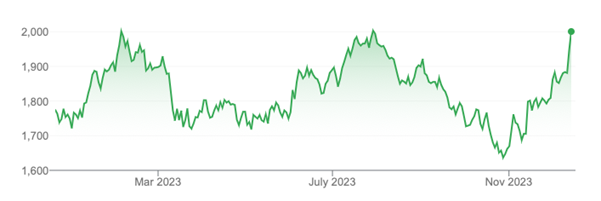

Figure 1. U.S. Russell 2000 Index (short term)

As this chart of the U.S. Russell 2000 Index shows, and as I have been forecasting for some time, small caps can react very, very quickly when the narrative becomes positive and sentiment shifts.

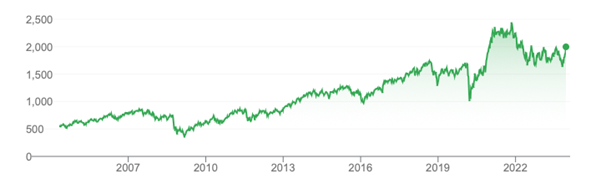

Figure 2. U.S. Russell 2000 Index (long term)

And, as this second longer-term chart of the Russell 2000 reveals, there’s still plenty of room to grow. I believe this enthusiasm is totally justified.

Why?, you ask. Well, let me explain.

First, small-cap stocks, those with a market capitalisation ranging from $300 million to $2 billion are known for their high growth potential. They’re often in the early stages of their growth cycles and poised to benefit from favourable economic conditions and improving sentiment towards risk.

Meanwhile, lower interest rates, which the Federal Reserve uses to stimulate economic growth, are particularly beneficial for small caps. When the Fed cuts rates, it signals a more accommodative business environment. This eventually leads to lower interest expenses for companies borrowing to fund their operations or expansion.

Lower costs mean increased profitability and more capital for investment in new projects, technology, and workforce expansion. Plus, it eases the cost-of-living pressures for consumers, leading to increased consumer spending, which directly benefits retailers and other domestically focused businesses. And who benefits most from these shifts? Well, of course, small caps! So, is it any wonder the small ordinaries index is already up 12 per cent since the end of October.

Just last year in November 2022, about a year ago, I mentioned that calendar 2023 would be a great year for innovative growth companies with pricing power. And, I was partly right. The “Magnificent Seven”, mega-cap tech companies saw strong gains. But what about the rest of the innovative universe?

Well, they were left behind, many innovative growth companies with pricing power are in the small-cap market. And unless we face a deep recession, which I believe is unlikely, the Federal Reserve has set the stage for these small caps to catch up in 2024.

The backdrop for our optimistic outlook is the Fed’s recognition of declining inflation rates. They’ve mentioned a cooling of inflationary pressures, which has led to favourable changes in yields on the 10-year treasuries.

I understand some investors are still cautious, citing concerns about a slowing economy and the risk of a recession. While I won’t predict a recession, I think a technical recession, which is two quarters of negative growth) is a more likely outcome than a deep one like we saw in the early ‘90s with 11 per cent unemployment and every third shop boarded up and closed down.

And, here’s something to remember: small-cap stocks often shine after recessions or during economic recoveries. They’re agile, adaptable, and can capitalize on economic upturns quickly.

As the economy moves away from higher inflation and interest rates, I believe small caps will lead the stock market recovery and play catch up to those magnificent seven mega caps. The resultant gap will spur investors to start scanning for opportunities among smaller capitalisation stocks.

Lastly, let’s talk a little bit about relative value. The P/E ratio for the S&P 600 Small Cap Index is at 13.2, which is marginally above its lowest levels since the beginning of the century. This is a big deal! Historically, when the P/E was low, it was accompanied by either surging interest rates and inflation or the recessions of the GFC and the pandemic. Right now, the economic and interest rate outlook, along with historically low valuations, makes small caps look very promising if not very promising.

In conclusion, the Federal Reserve’s move towards rate cuts next year is a game changer for small caps. They’ll benefit from lower borrowing costs, economic recovery, and relative value. 2024 could very well be the year of the small cap! So, if you’re looking for growth opportunities think about investing in small caps or in small cap funds.