Investor Insights

SHARE

What can we expect from stocks and bonds in 2024?

Since late October, financial markets have witnessed a significant shift, adjusting to a softer labour market and persistent disinflation. As an aside, the latter – disinflation – was a condition we wrote about a year ago, suggesting it should support the share prices of innovative growth companies, especially those with pricing power.

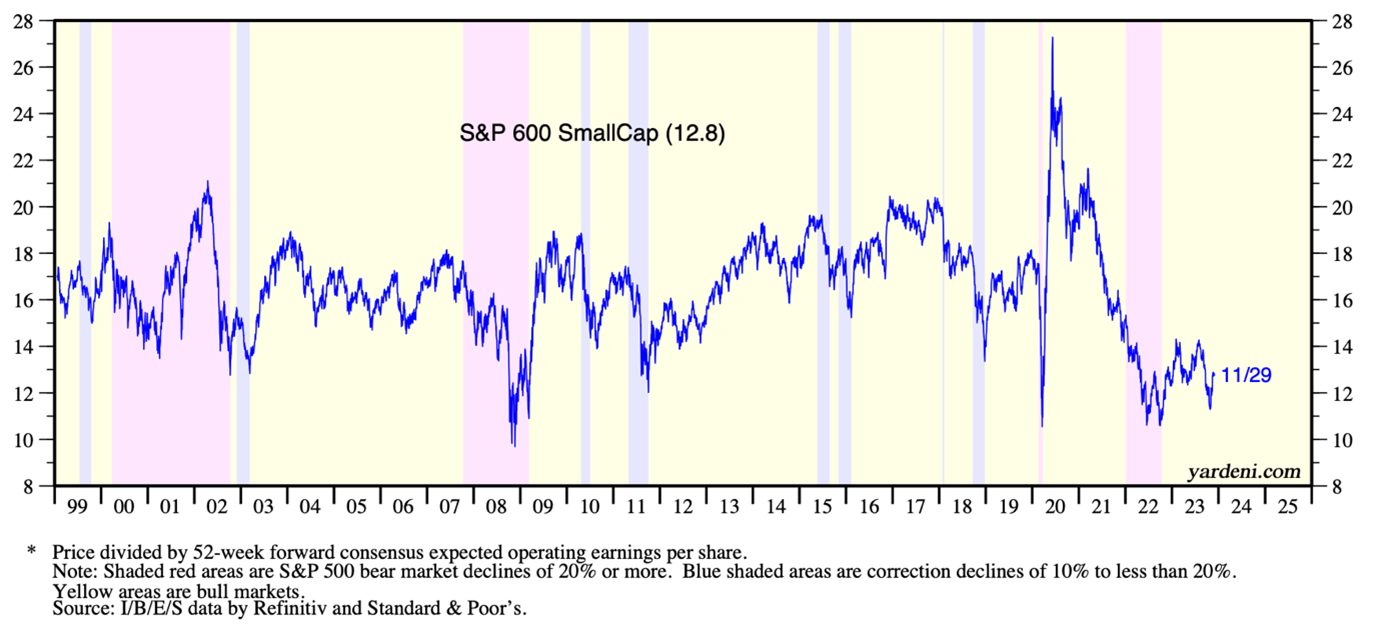

Of course, the Magnificent Seven qualify and have performed spectacularly. But I also thought at the time that many innovative growth companies were small cap and concluded small caps should do well also. As Figure 1 reveals, small-cap price-earnings (P/E) ratios, at least in the U.S., have remained at their lowest levels in 25 years, with the exception of the great financial crisis (GFC) and the COVID sell-off.

Figure 1. Small cap P/E ratios, back to the doldrums

The adjustment in financial markets to a softer labour market and disinflation narrative has manifested in a rally in bonds (Figure 2.) and some stocks, coupled with a decline in the U.S. dollar.

Figure 2. U.S. 10-year treasury yield

Historically termed the “reflation trade,” these market movements are now more intricately linked to anticipations of a policy shift by the Federal Reserve (Fed) to cut interest rates. Some strategists are calling the shift the “pivot trade”. Despite uncertainties regarding the Feds policy trajectory over the next few months, these analysts predict that the current rally in stocks and bonds will likely continue into 2024.

An ongoing tension exists between U.S. fiscal/budgetary expansion and monetary tightening, influencing economic and market performance. Despite the Fed pushing rates higher than expected, the U.S. economy has shown remarkable resilience, attributed largely to that fiscal expansion.

However, with unemployment rising to 3.9 per cent – a 21-month high – and with indicators including leading economic indicators (LEI), purchasing managers index’s (PMI), yield curve, gross domestic income (GDI), tax revenues, corporate profits, money supply, the savings rate, intermodal rail, and home affordability, appearing to be in recession already, recent trends suggest a diminishing impact from fiscal stimulus.

This development eases pressures in the bond market and favourably impacts stock markets. Meanwhile, anticipation of a softer approach to monetary policy is emerging, indicating that the Fed may have already surpassed the equilibrium interest rate.

Currently, markets have settled on a potential “soft landing” for the U.S. economy, characterised by non-recessionary decelerating growth and a downward trend in core personal consumption expenditures (PCE) inflation. Call it the Goldilocks scenario if you will.

However, markets rarely have their wishes fulfilled, so this positive outlook comes with risks. One significant concern is the possibility that the Fed has over-tightened its policies, potentially leading to a recession. Conversely, the risk of persistent economic strength and sticky inflation cannot be ignored. Despite these risks, the likelihood of a soft landing is bolstered by disinflationary trends driven by supply-side forces and a potential decline in aggregate demand.

In the event of a soft landing, stocks would be expected to outperform bonds. In a recession scenario, although stocks might underperform, the lack of clear signs of equity market overvaluation (Figure 1.), and relative to bonds, provides some reassurance that equities may not suffer much. Indeed, if rates are cut, another bull market could emerge. If inflation persists and the Fed continues raising rates, the resultant ‘higher for longer’ scenario would see investment portfolios continue to face challenges.

One can be cautiously optimistic if disinflation coincides with a soft economic landing. That’s the scenario that has helped the Magnificent Seven (M7). Given the outstanding performance of the M7, investors could conceivably look further down the ‘market cap’ and ‘quality’ lists for new equity opportunities to invest in.