Investor Insights

SHARE

Why IMDEX’s proposed acquisition of Devico is a great strategic fit

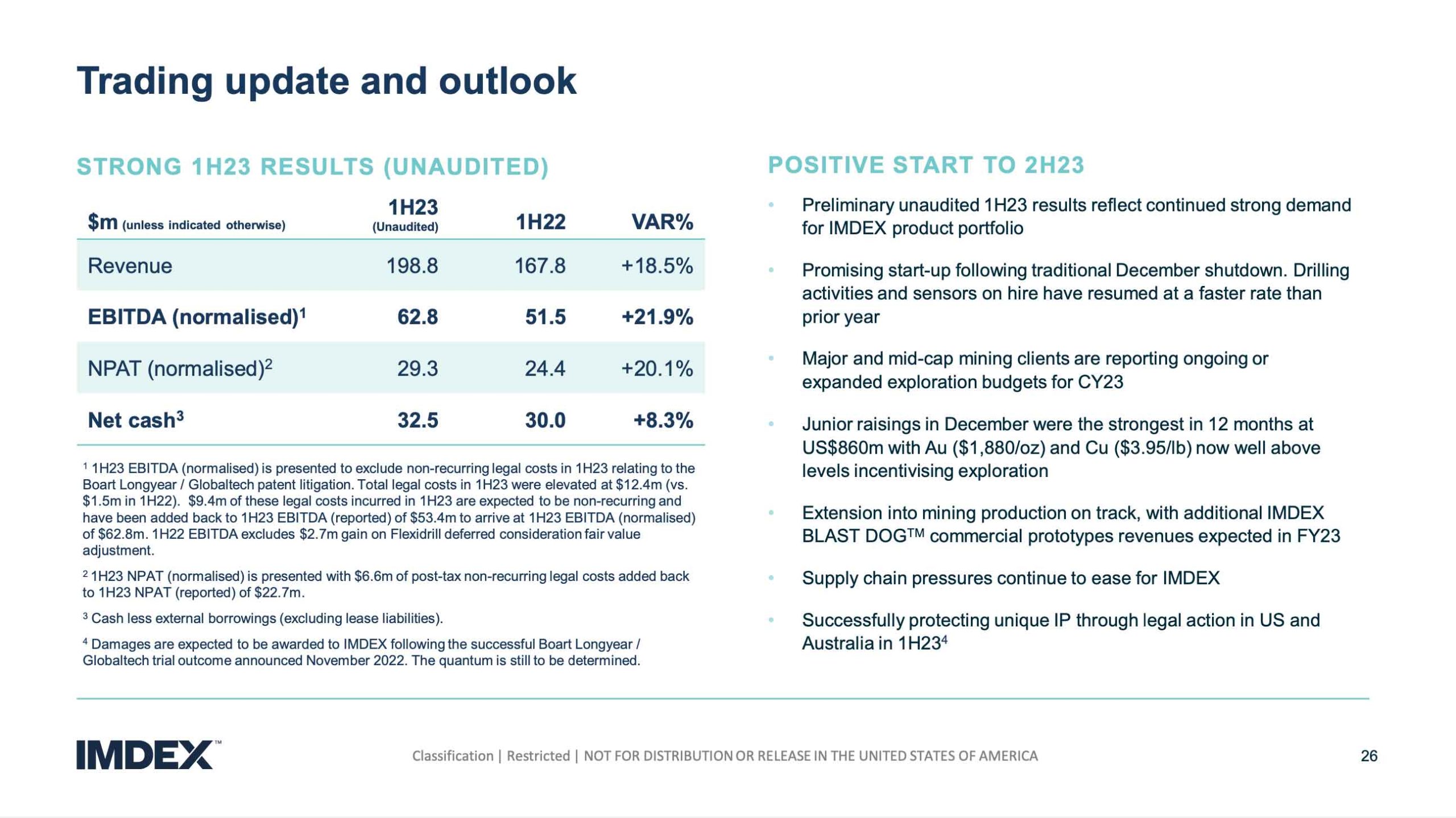

IMDEX (ASX:IMD) reported a strong set of 1H23 results, well ahead of consensus with revenue up 18.5 per cent from 1H22 and EBITDA up 21.9 per cent from 1H22. Despite great results these were overshadowed by IMDEX’s proposed acquisition of Devico, which appears highly strategic. Dominic joined IMDEX’s CEO Paul House to take a deep dive into the proposed acquisition which is highly strategic with strong synergies.

Transcript

Dominic Rose:

Welcome to the Montgomery Small Caps CEO Series. Today we’re pleased to be catching up once again with Paul House, CEO of mining technology company, IMDEX (ASX:IMD). Paul, always good to see you and thanks for making the time to chat today.

Paul House:

Always a pleasure, Dominic. Thanks for having me.

1H23 IMDE results

Dominic Rose:

Lots to discuss today, Paul. You’ve pre-released your 1H23 results, so we should probably cover off on some of the high points. But of course the financial results were overshadowed by the proposed acquisition of Devico, which is significant and appears highly strategic. So why don’t we start with the results and then we’ll move on to the deal. There was another strong set of results in 1H23 well ahead of consensus. Perhaps just take us through the highlights.

Paul House:

I think once again, we’ve been harping on about the importance of building a business model that outperformed market growth. And I think the first half of FY23 was a really great opportunity to demonstrate that. Many people will recall that there was a lot of uncertainty in the marketplace, whether that was geopolitical tension or inflationary pressures. But in particular within our industry, there was a lot of uncertainty around capital raisings in the TSX and otherwise, some slightly suppressed commodity prices throughout the first half playing through and how that might impact our business.

And at the time, we’ve always defended our business model to say, “well, the real test of our business, the real test of whether we continue to grow above market is can we execute our strategy and continue to build new products, conduct that solution selling part of our strategy in a way that means regardless of what’s going on in the market, we continue to outperform whatever proxy for market you might look at?” And I think the first half for us, most pleasingly was a real opportunity to demonstrate exactly that and it’s a testament to our teams around the world in the way they engage with the customers and deliver those really strong numbers.

How does Devico complement the existing business?

Dominic Rose:

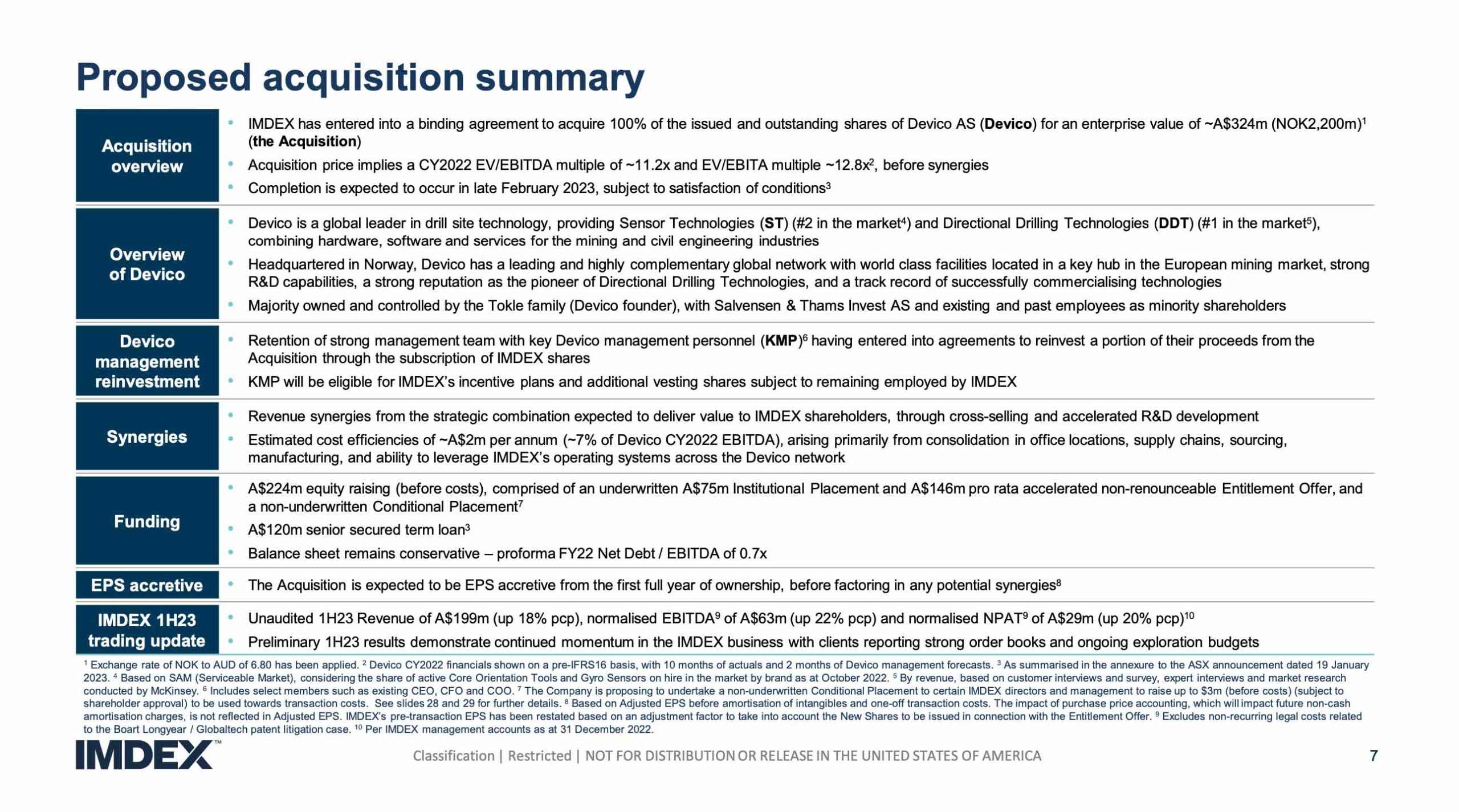

Congratulations on what was really a great result. So if we move to the Devico acquisition, a $324 million Aussie deal. So it’s material. And importantly it sits within the valuable part of your business, the mining technology part of the business, which obviously has those very attractive unit economics. So perhaps, you can walk us through the acquisition, what Devico do, how they complement the existing business and what benefits you expect them to bring to the group.

Paul House:

Of course. So we have very frequently articulated the desire to grow our business through acquisition or building new products or collaboration with strategic partners. On the acquisition side, we’ve done a number of smaller emerging technology or earlier stage developments where we have that unique shared risk model, which we tailor for individual opportunities. But we’ve always been on the lookout for something that gave us a bit more heft and a bit more structure. And certainly the quality of our business model and our balance sheet meant that we could do that. We’d been looking for some time, which is no secret. And obviously there’s been some pretty frothy multiples trading in some of the M&A activity that’s gone before us. So as a result we stopped and pulled back our focus a little bit and focused really on our core. So which companies really in our core space did we think were best in class at what they did, added genuine complimentary benefits to our portfolio and enabled us to consolidate and accelerate our own core business, if you like.

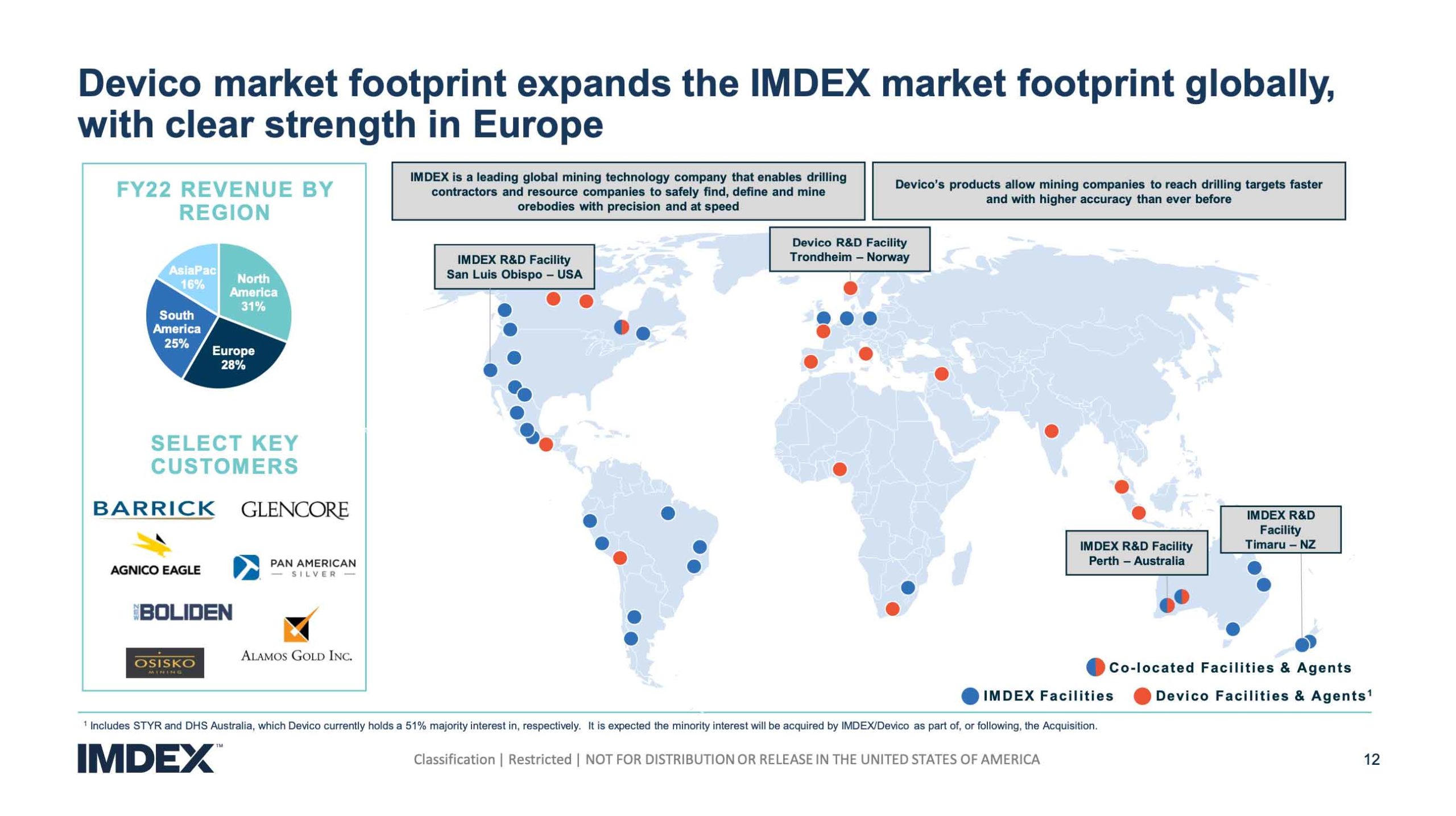

And so we ran the ruler over about a dozen targets and very easily Devico came to the top of that list. We’ve been working on that for nearly 12 months now in terms of a body of work. And the opportunity that it simply presents is you very rarely put number one and number two in a marketplace together without there being some regulatory complications or without there being some cultural mishaps. But strategically, it’s a very logical thing to do. And so as well understood as it is strategically, it is extraordinarily rare to do practically. And so in approaching Devico, we were very pleased both that they understood the strategic fit as well as what we learned together was that the cultural fit was stronger than we could have hoped. Now, the outcome of that combination of IMDEX and Devico is that it presents IMDEX with the number one market position in Europe, which we did not have. And it consolidates our number one market position around the rest of the world.

And so we now have a strong footprint in all the major mining regions or a stronger footprint in those major mining regions around the world than we did before. In addition to number one in Europe and consolidating number one globally, it also provides us the number one position in directional drilling, which is a technology that we’ve looked to add to our portfolio for some time. It perfectly complements our drilling optimization technology stack. And we’ve also taken on board what I think is the jewel in the crown, which is their R&D headquarters and manufacturing facilities in Trondheim, which gives us a really world-class physical presence in that Scandinavian mining region and a great access to their customer network and understanding of some of the unique challenges in that area.

Of course on the R&D side, the talent that we have access to in that area is wonderful. It also de-risks some of our supply chain in areas where they have built relationships with suppliers that are first class. And it also presents consolidation in other areas of our supply chain where the benefit of our heft and scale coming together is obviously significant. And then lastly, they provide a very strong reference gyro tool in the market, which complements our magnetic gyro and our north seeking gyro. And so you put those things together and we end up with a very complete technology stack in survey tools. And what that means is that we can give the right tool to any customer depending on their particular challenge, and so we are able to better service any given customer need.

What is directional drilling?

Dominic Rose:

Sounds great. And so Paul, you’ve mentioned directional drilling. For those unfamiliar with directional drilling, which I’d say would be most of us, can you please explain what it is and also provide some color to the comments that you’ve made a few times now around directional drilling being one of the fastest growing segments within mining technology?

Paul House:

Yeah, sure. Maybe the easiest way to think about it is, I’ll use a military example, but conventional drilling is a bit like ballistic missiles in that once they are set off, you have very limited ability to navigate the missile or the drill in this case. You can do it, but it tends to mean that you slow the drilling progress down and you can only navigate within a very narrow band of choices. So it’s more expensive, it’s slower, and you are limited into the degree to which you can navigate whilst drilling. And so directional drilling is a bit like guided missiles. So you increase your ability to navigate and turn the drill bit through the ore body, meaning that you can become very precise in targeting the ore body and where you would like to drill. And you can do that in a real time and dynamic basis.

You can do that without losing any pace. So it becomes faster, whilst you pay for the service, it actually becomes cheaper on a total cost of drilling program and of course you get more accurate data. Now, the way that is playing out in the marketplace is that as ore bodies become deeper and more complex, both of those factors play directly into the need for directional drilling. So conventional drilling or conventional exploration programs, you might drill five holes down to 800 meters and try and intersect the ore body that way. With directional drilling, what you can do is drill one mother hole down to 800 meters and then from that, spur off five or six daughter holes so you don’t have to redrill the first 800 meters to get to the target. So you save time and cost and you get greater detail around the ore body where you’re exploring. Now, that speaks directly to ore bodies increasingly being discovered or explored at depth.

But equally, the other major megatrend in mining is precision mining. Precision mining requires precision ore-body knowledge. Precision ore-body knowledge requires both precision tools and a lot more drilling. And so the ability to do a lot more drilling in close proximity at the end of a directional drilling hole rather than re-drilling every single hole makes that a much more affordable proposition. So we’ve long wanted to add directional drilling into our portfolio. It would take us seven to 10 years to develop and deploy that technology if we had decided to go it alone. But the opportunity to acquire the number one player in that space was simply too compelling to ignore.

Retaining Devico’s key personnel

Dominic Rose:

So, Devico being a founder-led private business, looks to have built quite a strong management team and culture around that team over the years. Perhaps you could just talk about how you structured the retention of the key personnel over there and how you’ve thought about integrating that business into your own.

Paul House:

I alluded earlier to the fact that when we started engaging with Devico, we articulated what we thought was a really compelling strategic fit. We liked the way they thought about technology improving the mining industry. We liked the way they thought about customer segmentation, geographic segmentation, product segmentation, all of which aligned to the way we think about the industry and where we think the industry can move to and should move to. What we hadn’t anticipated was that as we started to engage the teams, how quickly that led to not just a strategic fit but a cultural fit.

And so although they are founder-led, the way they engage with the industry and the quality of that leadership team means that we very quickly bonded over what kind of values we bring to the organization and what is our purpose as a business. And that has become an accelerator in terms of how we now define our integration plans together. And so more than having to encourage people to work together more than anything, we’re trying to hold them back until we can get the deal done, Dominic, which is a good problem to have. And so that’s been a really pleasant surprise and I think a really key asset that underpins what should be a very successful combination of the two businesses.

Are there any other deals in the pipeline?

Dominic Rose:

And as part funding of the deal, you’ve taken on some debt, yet the balance sheet is going to remain conservatively geared at 0.7 net debt-to-EBITDA. Can you perhaps just reminder us where the board sees a comfortable level of gearing for the right deal? And also maybe just talk to the M&A pipeline, are there other deals out there that you’re thinking about or do you think you have enough on your plate now bedding down Devico?

Paul House:

I’ll probably start by talking about our capital management policy. So we’ve been quite vocal and clear for a number of years that our capital management policy needs to be able to sustain our R&D investment, sustain our dividend payout ratio at the bottom of any future cycle. The underlying core quality of our business model today means that we have a very resilient EBITDA cash flow at the bottom of any future cycle. And as such, that dividend payout ratio and that maintenance of R&D is well and truly serviceable. Extending that, we thought that our balance sheet was relatively lazy and it had the capacity to service a debt which should protect shareholder returns and ensure that when opportunities like Devico come along, we can leverage the balance sheet to the advantage of our existing shareholders. And that’s what we’ve done.

Now within our core business, we’ve thought that we could withstand a debt ratio of 1.0. And depending on what target we were looking at, particularly if it was moving further downstream into the less cyclical part of the business or the industry, we could up that to 1.5 times. By taking a 0.7 times position today, it’s a neat conservative way of us moving into that space where we bring some debt onto the balance sheet. We’re very confident of our ability to service that obviously. But it also gives us some flexibility looking forward about what we might do next.

I think the way we are thinking about M&A is that yes, we need to bed down Devico, it is a significant or a material transaction. But for the reasons I’ve outlined, the work that we’ve done over the last 12 months in identifying Devico, the capability and capacity building we’ve done inside of IMDEX to be ready for such events and the planning we’ve done around integration already, given the strategic fit and the cultural fit of the businesses, we think that that integration process, whilst it will take time and resource, is relatively low risk. So we need to do a bit of work to move through that process and bed it down. And that is our absolute number one priority. However, we don’t see any shift in our strategy around using the ABCs of growth, or acquire, build and collaborate are being critical pillars as we continue to look forward.

How are the Blast Dog trials going?

Dominic Rose:

Paul, we’re running out of time, but perhaps before we go, just a very quick update on how the Blast Dog trials are going, if you would.

Paul House:

Business as usual, Dominic. So we identified that for the balance of this financial year, we wanted to execute the trials that we had in the pipeline and that is continuing as scheduled. Although I say as scheduled, a few weather events in Queensland and Chile and the normal challenges that come with permitting new technologies onto mine sites, which creates often some interesting conversations. Nothing we didn’t expect. And so those are all running to schedule and we’re very happy with the data that’s coming out. We expect that to run as expected through to 30 June.

Dominic Rose:

Great to hear. Look, well done on another cracking set of results for the half. And congratulations on what looks to be a fantastic deal in Devico. Thanks for your time today, Paul.

The Montgomery Small Companies Fund owns shares in IMDEX. This video was prepared 08 February 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade IMDEX you should seek financial advice.