Investor Insights

SHARE

Why small caps could rally from here

Back on 12 October last year, with the S&P500 in the grip of a bear market, we published a blog titled “Why it might be time to be greedy once more”. It’s turned out to be a good call, as the index has since gained 21 per cent. But not all companies have participated in the rally – large caps have easily outpaced small caps, which are now selling at very attractive prices.

As we now move into the year’s second half, Wall Street is abuzz with the latest rally in U.S. stocks, officially marking the birth of a new bull market. This bull market follows the conclusion of a bear market, characterized by a decline of at least 20 per cent in the S&P 500, which began on January 3, 2022, and bottomed out on October 12, after a 25.4 per cent tumble.

That bear market was a response to escalating worries about unprecedented inflation levels, and the consequent actions by the U.S. Federal Reserve. In its attempt to quash accelerating inflation, the Fed escalated interest rates at their faster-ever rate to their highest level since 2007. Their strategy was to dampen inflation by decelerating the economy, directly influencing bonds, and indirectly influencing the prices of stocks and other investments.

Nonetheless, and as we have seen throughout history, the bear market was a fleeting episode compared to past bull markets. Perhaps interestingly, it was also fleeting compared to the average bear market since 1950. Its nine-month duration and 25.4 per cent drop were notably milder than the average 13-month term and 34.2 per cent decline observed historically. This is arguably due to a resilient economy, a stable job market, and sustained household spending despite heightened interest rates.

But today’s rally is narrow, and like those seen in the 1980s and late 1990s, it is once again associated with a major technological revolution. And in the wake of the development of Artificial Intelligence (AI), we may be on the brink of similar market turbulence.

Consider for a moment what we have already seen. On the one hand, the rally of Nvidia’s stock is in response to massive revenue gains, which in turn are on the back of soaring sales of its H100 chip, which sell for US$40,000 each and are being purchased in the tens of thousands by individual buyers.

On the other hand, AI has spawned a generation of deeply convincing fake videos, one of which showed the Pentagon on fire, triggering the stock market to plunge briefly.

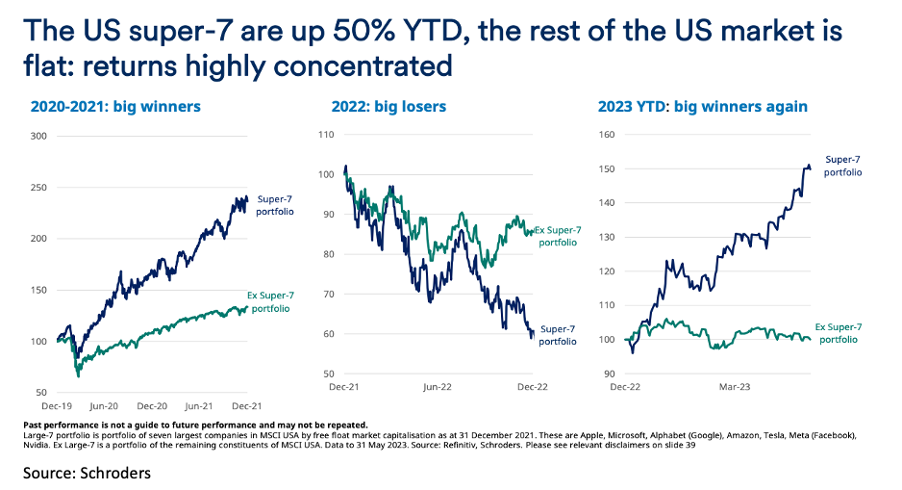

Tech behemoths have driven this narrow rally in the market, with large-cap companies like Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla contributing to over 100 per cent of S&P 500 Index returns year-to-date. This has also driven the Nasdaq 100 Index near a relative all-time high against the Russell 2000 small-cap index.

But despite AI’s hype and ability to redefine businesses and operations, investor scepticism is warranted. Meanwhile, the rally’s flip side is the widening performance gap between large-cap and small-cap companies, reflected in the discrepancy between S&P 500’s 13.5 per cent year-to-date return and S&P Small Cap 600 Index’s 4.2 per cent year-to-date return (Figure1.). I reckon this is producing potentially compelling investment opportunities in higher-quality smaller-cap companies that are currently undervalued.

Figure 1. Widening gap between US Big Tech and the rest

And thanks to the fact large caps are driving the gains, the gap between large and small is the widest in some time.

The Russell 2000 index of US small-cap stocks has suffered the ignominy of a major compression in PE ratios. It remains some 23 per cent below its November 2021 high. This compares to the S&P500, which is only nine per cent below its 2021 high. According to analysts, after the recent AI-driven rally, the Russell 2000’s returns relative to the S&P 500 is about 27 per cent, or almost two standard deviations, below its 20-year average.

A similar picture is emerging for Australian small caps. Since its peak in August 2021, the Small Ordinaries index has declined by more than 20 per cent, while the S&P/ASX 100 has fallen only 5 per cent. These Small Ordinaries index returns relative to the S&P/ASX100 are more than 20 per cent below the 20-year average, according to analysts, or more than 1.5 standard deviations, which is only five per cent from its lowest level in the last three decades.

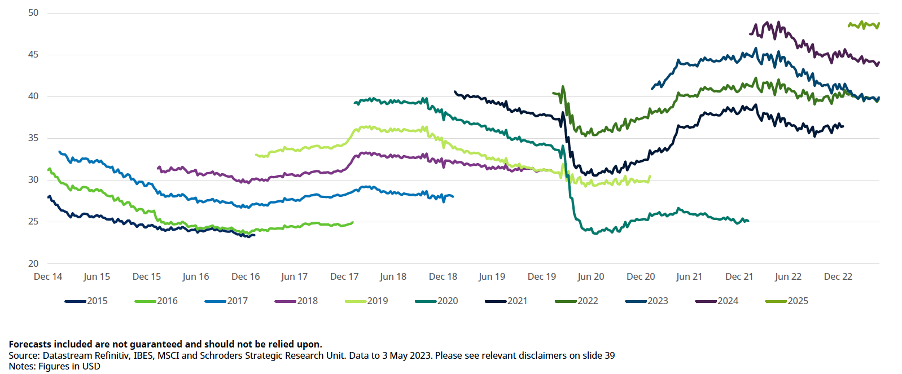

And that’s where earnings come in. As Figure 2., reveals, consensus expectations for global earnings are for zero earnings growth in 2023 but a strong rebound in 2024 and 2025.

Figure 2. Global Equities EPS Forecast

It’s also crucial to remember that bull markets typically endure for extended periods. On average, since 1932, they have lasted nearly five years and delivered a 177.8 per cent gain.

And when it comes to AI, revenue from core technology is projected to be far less than earnings from Big Tech’s existing services and hardware, as a recent S&P Global report suggests. A reassessment of the AI prospects for larger customers, like Google and Amazon, might mean a rotation out of the megacaps and into higher quality small caps with sound growth prospects, especially if AI levels the playing field for smaller companies, the way cloud computing has.

The current narrow bull market is largely based on AI’s potential to revolutionise businesses and enhance productivity. All that may indeed be true, but history is littered with the losses of investors who pursued gains from new technology. As I have often explained, new and transformative technology almost always benefits the consumer in preference to the investor. It is a vast understatement to suggest picking winners from new technology is difficult. Quite simply, the gap between the hype around AI and its actual financial implications could lead to potential investment disappointments.

What this rally has presented, however, is a historically wide gap between large-cap and small-cap companies. Many smaller-cap stocks are currently undervalued, and the highest-quality names present an attractive proposition, especially if earnings growth resumes in earnest.