Investor Insights

SHARE

Limits on growth

Value investing involves buying something for less than it is worth. In concept this is simple, but in practice it involves the more challenging task of estimating the future growth of cashflows over coming decades.

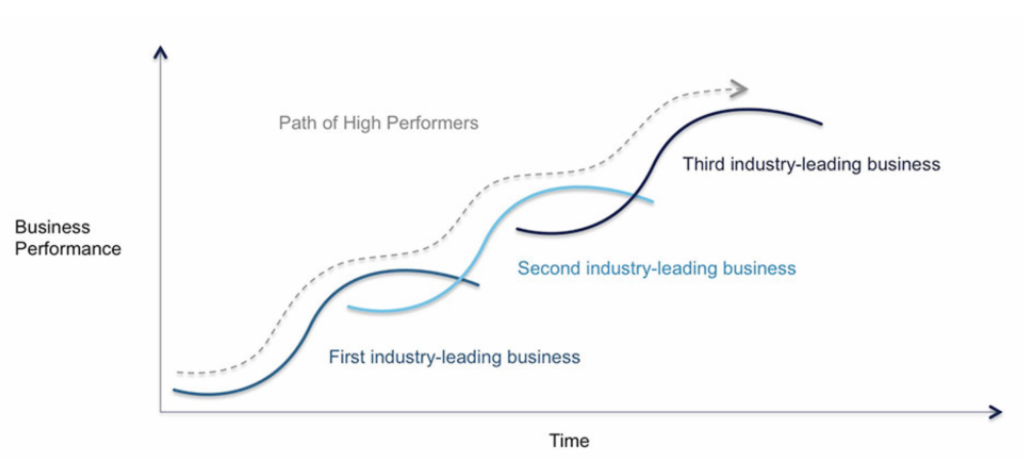

There are certain types of businesses that have characteristics that allow for multiple S-curve growth patterns. In other words, growth can be sustained for much longer than what might be expected at the outset. We will explore this, and the idea that there are constraints on growth.

If we think about growth in nature, there are natural limits dictated by the laws of physics. The adage “trees don’t grow to the sky” is rooted in physics: at a certain height, the base of the tree can no longer support the weight above, and will topple over. We find countless other examples of growth constraints.

Consider Dunbar’s number, which espouses that there is a cognitive limit on the number of people one can maintain stable social relationships with. Dunbar devised this rule after the Machiavellian Intelligence Hypothesis of the mid-1980s, which held that primates have large brains because they live in large social groups. In other words, the larger the group, the larger the brain was to process the more socially complex society. Dunbar’s number, also referred to as the “Rule of 150”, used a ratio of neocortal volume to total brain volume in humans to derive a number. Dunbar posited that exceeding a friendship number of 150 typically runs into cognitive limits and would be too complex for the human brain to optimally process.

Dunbar, after consulting the historical record, found remarkable consistency in this Rule of 150, noting that the average group size of hunter-gatherer societies was 148.4 individuals. Company size in armies spanning the Roman Empire to the Soviet Union also typically converged towards this 150 number as an optimal size. Much like the above examples, companies too are bound by the laws of nature. However, not all companies are constrained in the same way.

Let’s consider a business with a traditional, linear business model. Company A manufactures widgets. If it produces 100 widgets per year and wants to increase this number to 200 widgets produced in the next year, it will encounter capacity constraints if its manufacturing plant is only capable of producing 100 widgets per year. This growth can only be achieved if Company A invests in a new plant. If we assume that this company can obtain sufficient financing to continually expand its manufacturing capacity, can it do this indefinitely? The answer is no, and comes down to a consideration of the total addressable market (TAM).

If there is only demand globally for 1,000 widgets per year, then anything produced in excess of this by Company A will not be sold (at least not at current prices). As we can see with Company A, the company is physically constrained by how much it can produce from its factories. However, for capital-light digital platforms, enabled by the internet, these physical growth constraints are removed.

Consider Facebook (Nasdaq: FB), the social media giant and digital advertising platform that the majority of readers will be familiar with. This is a business that benefits from zero costs of marginal distribution. It essentially costs Facebook nothing if another user joins its network and begins consuming content (as well as revenue-generating adverts embedded amongst that content). Facebook, when considered next to Company A, is a capital-light business (although not capital free, given that aggregate growth requires some level of investment in server and data infrastructure to support this growth).

With that said, there is a risk that investors underestimate the future growth potential of Facebook. When looking at traditional, “old world” businesses that make things or provide services, there are scalability limits and growth constraints that mean that the majority of the time it is appropriate to taper down future growth rates. While Facebook will one day also succumb to the law of large numbers and reach a growth ceiling, it is likely that this is not simply because it has historically been growing at 30 per cent+ rates.

Facebook’s asset-light growth potential is also combined with a network of more than 3 billion users, which means that there’s the potential to rapidly (and note, cheaply and in a capital-light manner given the low costs of marginal distribution) scale up new businesses. In Facebook’s case, this could be related to payments or it could be e-commerce opportunities on Facebook Blue and Instagram. This has the potential to prolong growth in what is called multiple S-curve growth.

Source: Accenture; via Cole Scott Group

The likelihood of a digital platform business such as Facebook achieving successive S-curve growth is orders of magnitude higher than a linear manufacturing business such as Company A, which simply doesn’t have these growth options available.

There are important implications from this for investors, one of which is the potential underestimation of future revenue/earnings streams by mechanistically tapering down growth in the future when modelling these capital-light businesses. At Montaka we work hard to understand the economics of growth, and seek to consider the value of real options for certain businesses that might not be readily apparent today (nor factored into current share prices). Understanding that not all growth is created equal, and will come at varying costs for different businesses (namely in terms of capital intensity), is a key factor in identifying long-term “compounder” businesses that are capable of generating immense wealth for investors over time.

The Montgomery Global Funds and Montaka own shares in Facebook. This article was prepared 19 June with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.