Investor Insights

SHARE

Why we sold out of Redbubble

Most articles we read are about hot stock tips to buy. Occasionally there are articles about “shorting” opportunities, albeit most are directed to sophisticated investors given the risks around shorting (i.e. a potential loss that exceeds your initial investment). Very few articles talk about when to sell.

However, as I have previously written it can be just as important to know when to sell as when and what to buy, a key skill in active management.

The Redbubble thesis revisited

Last year, we highlighted Redbubble as a COVID winner with global aspirations. The business was a significant beneficiary of lockdowns and stimulus payments – with their years and dollars of investment in the artist platform, logistics and supply chains – paying dividends during the global e-commerce boom, especially in their key US markets.

The company’s execution during this period was stellar as it managed the significant spike in sales volume during the COVID work-from-home period. It was quick to take advantage of the boom in facemask demand – an entirely new product category – which immediately became a major contributor to revenue.

The marketplace platform also demonstrated the power of operating leverage, as 96 per cent growth in Revenue delivered 1,028 per cent growth in EBITDA (albeit off a low base) in the December 2020 half. Incremental margins of 25-30 per cent helped drive improved profitability. The Redbubble flywheel helped generate interest during lockdowns, with significant social media interest on Tik Tok and Twitter as well as more mainstream media articles drive users.

With all these positive tailwinds, why did we sell out of our holding in Redbubble?

In my previous article, the empirical paper “Selling Fast, Buying Slow” referred to three discrepancies between the buying and selling performance of investors:

- Investors displayed clear skill in buying – positions added to the portfolio outperformed both the benchmark and a strategy which randomly bought more shares of assets already held in the portfolio;

- Selling decisions failed to beat a no-skill strategy of selling randomly chosen positions – the level of underperformance was observed to be significant, such that it dragged down performance by 50 to 100 basis points; and

- Selling decisions coinciding with releases of portfolio-relevant information outperform – for example, following the release of company earnings announcements.

It is the final point which is relevant in our decision to sell our remaining holding.

Assessing earnings risk

At Montgomery, we not only focus on the price vs valuation of our investments but also the earnings risks – either higher or lower than market estimates. In many cases, it is these earnings risks that provide significant upside or downside potential relative to the current share price – especially for less mature businesses – as they drive the growth trajectory of future earnings.

For Redbubble, the share price faced its first significant road-bump following its DecH20 result released in February. The update revealed some additional costs related to paid acquisition and shipping, as well as reduced gross margins related to promotional activity in the December quarter. Some of these took the market by surprise, and the share price sold off ~15 per cent in the weeks following the release as it too caught up in the broader “rotation” out of e-commerce winners.

Earnings risk assessed for March quarter underpins exit thesis

The next stock-specific catalyst was the March quarter sales update. With the share price re-based to $5-6/sh after some margin-related earnings downgrades, it was important to assess the likely trajectory of earnings for the June half of FY21.

There were two key areas that underpinned our decision to sell prior to Redbubble’s March quarter earnings release:

Contribution of face masks to revenue

While many investors were aware of facemasks being a significant contributor to revenue growth, there were few estimates of the quantum of revenue contribution.

After peaking at ~25 per cent of revenue in July, we assessed facemasks had declined to ~5-7 per cent of revenue exiting December. This has a significant impact not only for Redbubble’s revenue for March, but also the difficulty in “comping” elevated face-masks sales that were unlikely to be repeated in the September quarter 2021.

We also assumed even if COVID did not recede, facemasks were unlikely to be a significant repeat contributor in the key US market due to i) greater competition in masks; and ii) warmer months in the northern hemisphere in conjunction with vaccine roll-out.

Impact of currency on revenue growth

Given the volatile moves in currency and the US’ contribution to revenue, this represented a significant swing factor in our estimates of Redbubble’s revenue trajectory.

With >70 per cent of Redbubble’s revenue from North America and the strength of the AUD vs USD, this represented ~15 per cent headwind to its top line versus the prior comparative period, which we assessed had yet to be fully factored in market earnings estimates.

Where we could have been wrong

While the decision to sell ahead of its April earnings release may appear to be obvious in hindsight, there were factors which we had to consider where we may be wrong:

- The market may have looked through currency impacted growth – our assessment of 80 per cent top-line is still impressive;

- An accretive, complementary transaction given its extremely strong balance sheet – which we deemed lower risk given RBL’s organic growth opportunities and relatively new CEO;

- Potential recovery in gross profit and EBITDA margins;

- Our sales estimates are wrong, and the company could deliver higher than expected.

All of these factors (and other unexpected positive developments) may have resulted in a higher share price. Despite this, we deemed the risk skew to the earnings and subsequent share price impact was to the downside.

Where to given sell-off?

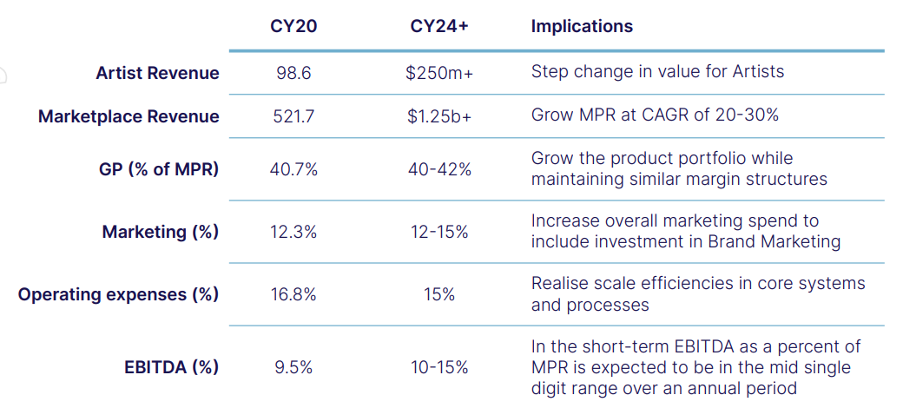

With the Redbubble share price having re-based once again (more significantly than we had anticipated) – and with incremental new future sales targets, earnings and profit margins and investment focus areas, it may be worth re-assessing the shares once again as an investment opportunity.

Many of the aspects which initially attracted us to the Redbubble business – the flywheel, operating leverage, investment in supply chains, global reach and aspirations – remains intact.

There is also increased awareness of the Redbubble brand given the spike in website viewer traffic and new customers acquired during COVID.

It is also clearly a much more valuable company coming out of COVID than it was going in, and should new CEO Michael Ilczynski and the Redbubble team start delivering on its aspirational targets, will likely become more valuable over time.

Please click here to revisit my post on when to sell a stock:

ANALYSIS IN SELLING COULD BE JUST AS IMPORTANT AS BUYING