Investor Insights

SHARE

City Chic accelerates global expansion

In the week before Christmas, City Chic Collective (ASX:CCX) rewarded patient investors with what looks to be a highly strategic acquisition; securing the e-Commerce and wholesale assets of UK plus-size women’s retailer Evans from the Arcadia Group (debt-laden owner of Topshop) which recently entered into administration.

The deal was struck three months after CCX disappointingly fell short bidding for Catherines’ online assets (a US plus-size retailer) at a bankruptcy auction and deliberately follows a similar playbook – opportunistically acquiring databases of customers within its niche plus-size category, at distressed prices.

And Evans is by no means a consolation prize – the acquisition delivers CCX a market leading brand with a loyal customer base and high online sales penetration, providing a solid platform to launch into a third geography for the company; the UK women’s plus-size market is worth in excess of £5 billion (A$9 billion) annually and remains underserved.

The deal is expected to be earnings accretive in year one and we see scope for CCX to materially grow these assets and gain market share, particularly through product expansion, cross-selling and effective digital marketing. Also, a firm UK foothold should serve as a launch pad into the European plus-size market in good time, further expanding the addressable market.

Importantly, after funding the £23 million Evans purchase, CCX retains $80 million of cash plus an undrawn A$40 million debt facility, ample capacity for additional strategic acquisitions and growth initiatives. The traditional ‘bricks and mortar’ retail model is under immense pressure globally, and CCX remains in the box seat to take advantage of distressed sales.

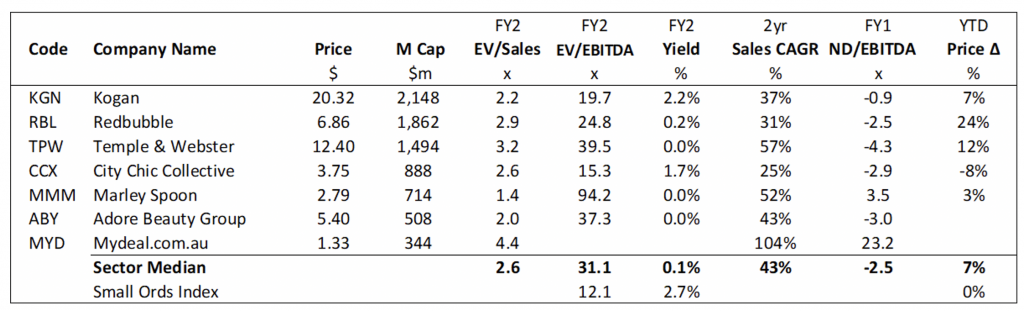

Although the stock has bounced since the announcement, we still see plenty of upside from here. CCX is trading on 15x FY22 EBITDA which we consider relatively cheap for the quality and growth potential of the business (see peer comparison table below).

Key acquisition details:

- Acquires online assets. On 21 December 2020, CCX announced it had agreed to acquire the key assets of the Evans e-Commerce and wholesale business (comprising the brand, intellectual property, customer base and inventory) from Arcadia Group which entered administration in late November 2020. The transaction excludes the Evans ‘bricks and mortar’ store network of over 100 locations throughout the UK (30 standalone stores, 70 concessions).

- Cash funded with ample balance sheet capacity. The £23 million (A$41 million) purchase price will be funded from existing cash reserves (CCX raised $110 million back in July 2020 ahead of the Catherines auction) with deal completion on 23 December 2020.

- Valuation looks compelling at <1 sales. The Evans assets being acquired generated £26 million (A$46 million) of sales in the 12 months to August 2020, implying a price to sales multiple of less than 1x.

- Market leading brand. Evans is a leading UK-based retailer of women’s plus-size apparel and footwear, targeting a broad customer base across the conservative and fashion segments (similar product and customer positioning to Avenue which CCX acquired in 2019). Established in 1930, Evans has a longstanding history as a high street retailer with a significant and loyal customer base (19 million annual website visits). The business is one of only a handful of tier one plus-size players in the UK (unlike the US market which is much more competitive) and CCX management regard Evans as the global benchmark in plus-size retailing.

- High online penetration. Evans’ digital transformation is well progressed; prior to COVID-19, the total Evans business (stores and online) generated over £60 million of annual sales with almost half direct-to-consumer sales coming through the digital channel. As such, CCX highlighted Evans generates much higher returns on capital compared to other acquisition opportunities it has assessed recently. Post completion, CCX’s online penetration increases to around 75 per cent (vs 2/3rds FY20a).

- Reduced sales leakage risk. The Evans store portfolio has been shrinking for a number of years (only 30 standalone stores remain) with customers progressively transitioning online; CCX expects this will help minimise e-Commerce sales leakage while the administrators liquidate the existing store stock (agreement allows store stock liquidation until the end of March 2021).

- Platform for global expansion. Evans provides CCX with a solid platform to launch into a third key geography; the UK women’s plus-size market is worth in excess of £5 billion (A$9 billion) annually and remains underserved (compares to Australian market worth $1 billion and US market at $30 billion).

- Solid growth potential. CCX sees immediate opportunity to add casual product lines (as it has done with Avenue during the pandemic) as well as cross-selling more fashionable items to the UK customer base in time. We also see potential to launch Evans into the European market once the UK foothold is bedded down. Additionally, CCX may bring the more conservative Evans brand into Australia to increase its addressable market (CCX’s existing fashion-forward brands only target a fraction of the total Australian plus-size market). The company plans to launch Avenue into Australia this year for similar reasons.

- Earnings per share (EPS) accretive. CCX expects the Evans acquisition to be earnings accretive in the first full year. On the conference call, management noted that Evans’ operating margins will be similar to the existing CCX business (c.15 per cent EBIT margins).

Source: Factset

The Montgomery Small Companies Fund own shares in City Chic Collective . This article was prepared 18 December with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade City Chic you should seek financial advice.