Investor Insights

SHARE

Is it time to switch to optimism?

After a few tough months, Australia is starting to come out of hibernation, and investors are looking ahead – as reflected in our rebounding sharemarket. But they’ll need to be selective in their stock selections, because some businesses will do far better than others in our post-lockdown world.

As my colleague Tim Kelley recently wrote here there are good reasons to believe the worst with respect to COVID-19 is behind us. Indeed, investment markets don’t need the problems to be solved, they merely need the worst to be behind us. And the recent strength in markets appears to reflect a belief in a better future.

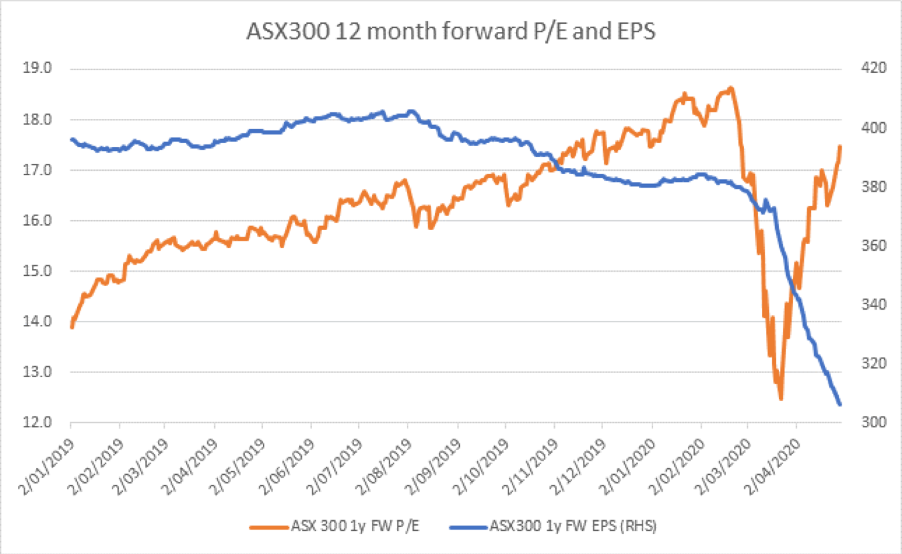

The recent rally and sustained recovery in share prices has also expanded the price to earnings ratio for the ASX300 to 18 times earnings. While PEs aren’t always a reliable gauge of value, in aggregate they can be helpful in establishing whether sentiment is dominated by enthusiasm and optimism or pessimism and hopelessness.

Recently Andreas Lundberg put together the chart shown in Figure 1.

Figure 1. ASX300 PE v EPS

Figure 1. reveals sentiment is perhaps as optimistic as it has ever been (noting that PE’s at the end of calendar 2019 were the highest on record). Notwithstanding the fact that a multitude of companies have pulled their guidance for FY20 and FY21, consensus earnings have plunged and multiples have returned to levels seen at the peak of the prior boom. Obviously, if earnings expectations recover materially in the near future, the forward PE will contract – all else being equal. The question of course is whether a v-shaped recovery is warranted.

With consumption a significant proportion of economic activity and output, it’s worth considering the recent aggregate consumption data to help understand whether complete optimism is warranted.

March total retail sales were up 10.1 per cent year-on-year and 8.5 per cent higher month-on-month. The significant year-on-year jump was due to stockpiling and panic buying of liquor (+33.9 per cent), pharmacy items (+29.4 per cent), and groceries (+26.7 per cent), ahead of expected lockdowns. Anyone lining up at Bunnings for ‘essential’ items would not be surprised to also learn the Hardware category saw retail sales up nearly 18 per cent year-on-year, while recreational goods were up 16.7 per cent.

Cafes and restaurants saw year-on-year declines of 31.5 per cent, clothing was 27.3 per cent lower, takeaway was down 10 per cent and furniture was down 5 per cent.

Broker channel checks and updates from the likes of Wesfarmers (owner of Kmart and Target), as well as and Bapcor (Bursons and Autobarn) reflect a material deterioration in trading conditions into April for discretionary retail. Further, Shoppertrak foot traffic stats, which is reported to have a discretionary clothing bias, declined 85 per cent in April.

It’s not all bad news. JBH’s third quarter trading update (ending March 31st), revealed very strong – 11 per cent like-for-like sales growth for JB-branded Australian stores and 14 per cent like-for-like sales growth for The Good Guys (+14% LFL). More importantly the strength seen while the most severe lockdown measures took hold, is reported to have continued in April and early May.

As mentioned earlier, retail sector PEs of 16.5 times are at the upper end of recent bands following the recovery in share prices but arguably the high PE is a function of depressed short-term earnings.

What is important to keep in mind is that some companies will emerge post COVID-19 with material levels of debt and those that manage to bring their debt levels down will do so by raising equity at relatively depressed share prices. We tend to be cautious about debt and being diluted.

Importantly, the surge in retail sales values in the March quarter was at least partially a reflection of rising prices. The 1.9 per cent quarter-on-quarter rise in the retail sales deflator is reported to have been the greatest since the introduction of GST 20 years ago. According to one economics report, despite the 2.7 per cent quarter-on-quarter jump in sales values, sales volumes rose by just 0.7 per cent. One would expect, given lockdowns (which commenced in earnest at the end of March) and subsequent social distancing, that second quarter 2020 retail sales volumes will slump.

Investors should therefore probably temper their enthusiasm. The slump in expected second-quarter volumes could result in a reassessment of current multiples. And even the significant jump in online sales being reported by the likes of Temple & Webster and JB Hi-Fi may be pulling forward future sales.

Of course, it’s not all warnings. There will be many positive stories to emerge out of this experience. One, for example is that Woolworths has signed up about a million new online and rewards customers. When combined with advanced data analytics, the defensive Woolworths may become a growth story.