Investor Insights

SHARE

Retirement planning assumptions and solutions

Recently, Morningstar’s director of personal finance, Christine Benz, penned an insightful note explaining some common and dangerous assumptions individuals make when planning for retirement.

In addition to sharing a fondness for the early 1970s sitcom The Odd Couple, Christine outlines what I believe are indeed perilous beliefs.

Firstly, many assume that the stock and bond market returns will always be robust. Although the S&P 500 showed robust returns from 1926 to August 2023, periods of weak returns, such as the “lost decade” ending in 2009, caution against such optimistic projections. For example, drawdowns of approximately 40 per cent typically occur once per decade.

From the perspective of sequencing risk, this is particularly relevant at the moment, when a cohort of investors – the baby boomers – who were once accumulators, begin to decumulate en-masse. The effect on the multiples of earnings and revenues investors will be willing to pay cannot be understated.

Secondly, there’s a tendency to believe that inflation will remain low. This has been the case for much of the past two decades. However, recent trends underscore the risks of underestimating inflation’s impact on retirement savings. As costs rise, retirees may need to withdraw more from their portfolios than anticipated.

Another risky assumption is the belief that one can work past the age of 65. The appeal of working longer is evident, as it can enhance retirement portfolio durability. But a significant number of workers exit the workforce earlier than planned due to reasons ranging from health issues to job demands.

Lastly, expecting to receive an inheritance can be a precarious retirement plan. A noticeable disconnect exists between what children expect to inherit and what parents actually intend to leave behind. This can lead to overspending during peak earning years and potential financial shortfalls later in life.

To counter these assumptions, Christine Benz notes experts recommend several steps. One should employ conservative market-return projections and adjust withdrawal rates accordingly. For inflation, it’s wise to use longer-term numbers as a baseline and consider including inflation hedges in one’s portfolio. Those who plan to work past 65 should also have backup measures, like boosting their savings rate.

I would add to the list of solutions to include the emerging asset class known as Private Credit.

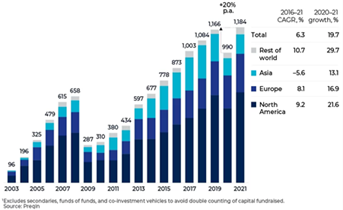

As Figure 1., reveals, Private Credit is gaining traction as an asset class. And only recently, as major Australian banks follow the path set by their European and U.S. counterparts to focus on lending to the largest corporates, have local investors had the opportunity to participate in this opportunity for diversification, monthly cash income and potentially higher income returns.

Investing a portion of one’s portfolio in a private credit fund represents a strategic move that can yield substantial benefits (see Table 1). As an alternative investment strategy, private credit funds are gaining significant traction in the Australian financial landscape, particularly among those seeking to optimise their portfolio’s returns and durability. These funds offer a unique blend of advantages that traditional investment avenues often fail to provide.

Figure 1. Private Debt is gaining traction as an asset class. US$billion*

*Source: Preqin

(You can find out more about Private Credit Outclassing the Asset Classes here)

Investing in private credit (also known as private debt) is increasingly considered a prudent strategy for those seeking diversification and relatively reliable returns.

Meanwhile, advisers, researchers, and consultants – those who provide important advice on portfolio construction – are recognising this emerging asset class. The benefits of consistent monthly income and uncorrelated returns, and the important economic role private credit plays in supporting Australian businesses, cannot be ignored.

Table 1. Private Credit’s features and benefits

| 1 |

Consistent cash flow: A primary appeal of private credit investments is the consistent cash flow they can provide. Most private loans, especially to mid-sized businesses, have regular interest payments. This is in contrast to equities, which may or may not provide dividends and can be subject to volatile price swings. |

| 2 |

Secured assets: Many private credit investments are secured by tangible assets. If a borrower defaults on their loan, the lender may have a claim to certain assets as collateral. In contrast, equity investors are positioned at the bottom of the capital structure, meaning they are the last in line to receive any remaining assets in the event of bankruptcy. |

| 3 |

Protection from volatility: The private credit market is less correlated with public investment market swings than equities. This means that during periods of stock market turmoil, private credit portfolios can act as a ‘cushion’, reducing the overall volatility of an investment portfolio. |

| 4 |

Reliable returns: Private credit offers reliable returns based on interest rates set out in loan agreements. This contrasts with equities, where returns are highly dependent on company performance, market perception, and broader economic factors. |

| 5 |

Contractual obligations: Whereas returns from equity investments depend on company performance (in the form of dividends or stock appreciation), returns from private credit returns are typically contractually obligated. Borrowers are legally required to make interest and principal payments. |

| 6 |

Diversification: Incorporating private credit into a portfolio allows investors to achieve greater diversification. It’s another asset class, with a different risk and return profile compared to equities, that can work to balance out portfolio returns over time. |

| 7 |

Higher yield potential: Private credit can offer higher yields than traditional bonds or other fixed-income assets, given its bespoke nature, the direct relationship between investor, manager, originator and borrower, and the link to corporate lending. |

| 8 |

Direct relationship with borrowers: The direct relationship between private credit lenders or originators and borrowers, allows for more flexibility in loan terms, better monitoring of the loan, and more efficient negotiations should a borrower face financial difficulties. |

| 9 |

Less competition and more opportunity for due diligence: Unlike the equity markets, which are saturated with analysts and institutional investors, the private credit space often has less competition. This may currently allow for more attractive pricing (yields and returns) and the opportunity for patient and in-depth due diligence. |

| 10 |

Increasing market and maturity: Over the past decade, the private credit market has matured significantly. With this maturation comes better infrastructure, more data for making informed decisions, and a larger number of experienced participants, making it a more viable investment option for many. |

And while there are at least ten good reasons for a retiree to consider Private Credit (Table 1.) it is the performance of the Aura High Yield SME Fund over the last six years that is particularly pertinent when considering the dangerous assumptions commonly made by individuals planning retirement.

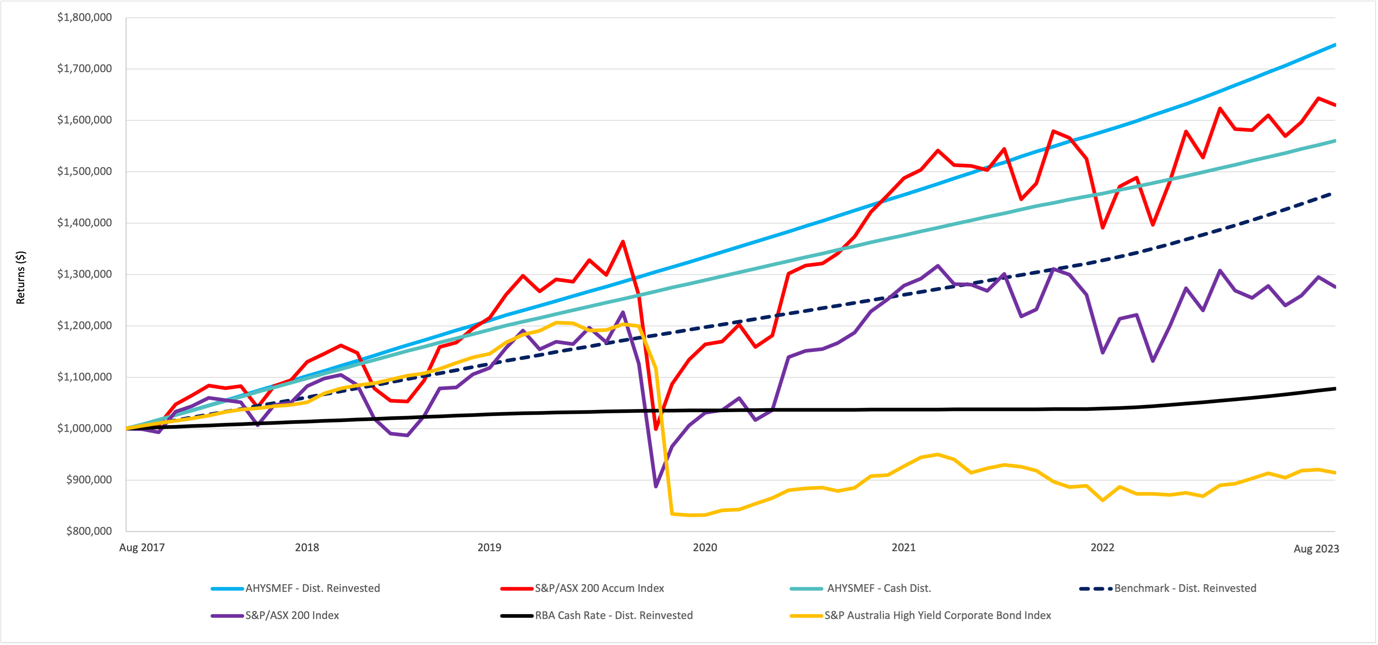

Figure 2. Comparative returns since inception (1/8/2017) to 31/08/2023 (After all fees)

Source: S&P/ASX 200 (^AXJO) Adjusted Close Historical Data.

Source: S&P Global – S&P Australia High Yield Corporate Bond Index Historical Data.

Performance net of fees and expenses (1) Inception date 1-Aug-17, (2) Benchmark is RBA cash rate plus 5% p.a. Returns assume reinvestment of all distributions. Past performance is not a reliable indication of future performance

Morningstar notes one of the most dangerous assumptions retirees can make when planning their retirement future is that the stock and bond market returns will always be robust. As Figure 1., reveals, since its inception, the Aura High Yield SME Fund’s (The Fund) returns have materially outperformed the S&P/ASX200 Accumulation Index without the commensurate volatility typically associated with higher-returning asset classes. Indeed, it is the case that since inception, The Fund’s returns have been higher than Australian equities, as measured by the S&P/ASX200 Index, assuming both income and dividends were paid out, rather than re-invested.

Each year, the Australian Government requires superannuation account holders receiving an income stream to withdraw at least the minimum pension payment from their super, as part of their annual income stream. This is known as the minimum pension drawdown. For a retiree planning their finances and starting a retirement income stream, they will inevitably have to draw down on capital if the yield on their investment is not high enough to meet minimum pension drawdown requirements.

Drawdowns can force investors to sell more units/shares, for example when equity markets fall, leaving much fewer shares remaining to carry the responsibility of recovering the wealth that was lost to the decline.

If the yield is sufficiently high, the minimum pension drawdown need not impact the capital invested. Figure 2. offers retiree investors a stark comparison with which to assess their preferred course and outcome. Readers should note the volatility of the S&P/ASX 200 Index as well as the Australia High Yield Corporate Bond Index.

Morningstar also notes the dangers associated with the assumption that inflation will return to the low single digits we have, until recently, been accustomed to. Inflation erodes the purchasing power of your dollars. If everything you buy rises in price by five per cent and you are earning a yield of four per cent on your investments, your purchasing power is going backwards by one per cent per year. Often, the products and services we buy, however, rise in price much faster than official rates of inflation suggest, which means you are going backwards at a much faster rate unless you can invest at a higher rate of return.

Morningstar notes that as costs rise, retirees may need to withdraw more from their portfolios than anticipated.

One solution is to find less volatile investments offering potentially higher yields. The growing asset class that is Private Credit is aiming to achieve that. Since its inception on 1 August 2017, The Aura High Yield SME Fund has delivered a compound annual return of 9.61 per cent after expenses and assuming reinvestment of distributions. (Distributions have been paid monthly, and the unit price has returned to $1.00 over the 73 months since inception). This has been well above inflation rates.

It is also the case that The Fund has paid monthly cash income and, as of 26 September 2023, has not experienced a negative month since its inception.

Finally, Morningstar alludes to an assumption many retirees make, that they can work longer to supplement their retirement income needs or preserve their investments for longer. But of course, working longer is not retiring. Might another solution for consideration be private credit?

Private Credit is a burgeoning asset class, with benefits that include diversification and potentially higher returns that are generally uncorrelated with investment markets. With more retirees seriously considering their finances and their plans, Private Credit may suit the needs of some, if not many.

You can read more about Private Credit through the following links:

Why Private Debt may be superior to bonds

Private Credit: A Smart Choice

Private Credit Outclassing the Asset Classes

You can read the full Morningstar article here.

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.